The tax year in Canada ends on the last day of the year, and people all over the country will be filing their tax returns in the coming months.

The deadline for the 2023 tax year is April 30, 2024, for individuals and June 15th if you are self-employed, so now is a good time to start planning your return.

Filing a return can be daunting, but you can make it a lot easier by using tax filing software.

If you don’t like spending lots of money on expensive software, you will be pleased to know that there are several free tax software tools in Canada.

But what is the best free tax software in Canada? Is it always really free, or are there costs involved?

This guide looks at the best free income tax software in Canada to save time and effort in filing your tax return.

Best Free Tax Software

There are several options when it comes to free tax software. The list below provides you with nine of the best to consider.

Some have paid versions if your requirements are more advanced, but they all have free options. So you can usually stick to the free versions for most situations.

1. TurboTax

TurboTax is a professional tax software product in Canada and is also available in Quebec. It offers several plans, but the free version does everything you need for a straightforward tax return.

It provides a step-by-step process to make it simple, and it stores your information to use the following year.

You can use TurboTax on your computer or any other device, including a smartphone. It is NETFILE-certified, and you can use the free version to submit up to 20 returns each year.

It is also compatible with Auto-fill My Return (AFR). This imports tax info from the CRA to speed up the process, and it is a common feature in many tax software products.

It has a 100% accuracy guarantee, meaning it will repay the penalties if it makes an incorrect calculation. If you have to make any adjustments, you can use ReFILE.

The free version does not have phone support from a tax specialist. However, you can access the TurboTax Community forum to find answers or post questions.

The free version covers employment income as well as unemployment and pension income, and it can even cover COVID-19 benefits and repayments. However, it does not support some deductions and credits like donations and investment income.

The Deluxe and Premier plan to provide more features, including the option to claim donations and medical expenses, find tax-saving opportunities, optimize returns, file rental property income, capital gains and losses, etc.

2. Wealthsimple Tax

This software used to be called SimpleTax, a popular free tax software for users in Canada. It is available online but also comes with a mobile app, so you can use it on multiple devices.

One thing that makes this stand out is that it is free, even for complex tax returns. They ask for a donation, but you don’t have to pay anything to use it.

This means you can get access to advanced features like the option to file crypto tax for free. This is something that many other tools do not offer.

Wealthsimple Tax syncs with major exchanges like Bitbuy and NDAX to calculate capital gains.

It is certified to use NETFILE and is a comprehensive solution that you can use to file almost any return. It also includes rental income, medical expenses, self-employment income, and much more,

It is very easy to use with its simple step-by-step process and offers a 100% accuracy guarantee. You can also use the refund optimizer to get a maximum refund.

Being compatible with Auto-fill My Return, you can import income tax slips and investment information directly from CRA and Revenu Québec.

Support is available via phone, chat and email, so you can speak with a real person.

3. H&R Block

You can find the free online tax software from H&R Block here. Like many of the software products in this list, it offers paid versions, too, with the Assistance and Protection products costing $24.99 and $44.99 per return, respectively.

H&R Block has decades of experience in tax services in Canada, and it has over 1,000 offices for in-person tax services, so it’s a company you can trust.

The free professional tax software is compatible with Auto-fill My Return and is NETFILE-certified. It also provides an automatic return optimization feature to maximize your refund or minimize the amount of tax you owe.

It is simple and easy to use and offers step-by-step guidance to walk you through the process. There is also an online help centre you can access.

The SmartSearch feature allows you to search hundreds of forms and slips and add them to your return.

The paid versions offer more advanced features like customized tax tips, the ability to transfer your previous year’s tax details, and priority support. Compare the versions to decide which is most suitable.

4. UFileFREE

You can use this software online, so there is no need to download anything. However, there is also a Windows version, UFile Windows, which starts at $22.99.

UFileFREE is free for students, no matter how high their income is. However, if you are not a student, you must answer some questions on the website to determine whether it is free.

If your income is less than $20,000, you are filing a simple tax return, or this is your first federal tax return, it should be free. However, if you have to pay, the fee starts at $19.95 to use uFile Online.

It offers all of the standard features that you would expect from tax software. For example, it is NETFILE-certified and secure. It is also available in Quebec.

The free version has free email support. However, if you want to access phone support, you must use the paid version.

5. AdvTax

AdvTax is powered by Aclasssoft and can be accessed online. It is free to use in many situations, but not all. It claims that NETFILE users have a 50% chance of being able to use it for free.

It has support for several languages, including English and French. It is also NETFILE-certified.

The website leaves a lot to be desired, but the product itself is simple to use, and it should only take a few minutes to complete a simple return.

It can download data from CRA to use the auto-fill function, and it has a useful Tax Checklist so you can make sure you don’t miss any tax deductions.

6. GenuTax

If you want to use free tax software that guides you through the process and makes filing your return quick and easy, GenuTax is a good choice.

This NETFILE-certified software is completely free to use, but donations are appreciated.

One disadvantage of this software is that it is only available as an application for Windows. Therefore, if you do not have a Windows computer, you will not be able to use it.

However, if you can use it, it has a step-by-step interview feature to guide you through the process.

You can also use it to process up to 20 returns each year, and there are no restrictions based on income level.

It handles most tax situations, including rental properties and capital gains. It’s also compatible with Auto-fill My Return and ReFILE if you need to change a tax return.

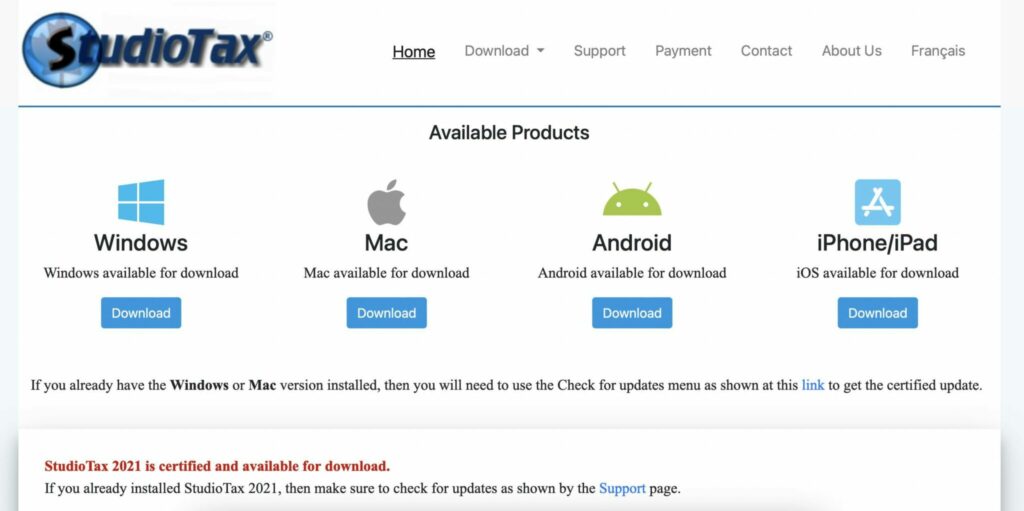

7. StudioTax

StudioTax offers tax software as a download for computers (Windows and Mac) and portable devices (Android, iPhone, iPad).

It claims to be the most secure option for preparing and filing a tax return. However, while it is free to download for iOS and Android devices, you may have to pay for the computer version.

The cost for a license is $15, which provides up to 20 returns in the same tax year.

However, it is still free for people in the Northwest Territories, Nunavut and Yukon, and if your income is below $20,000.

It is NETFILE compatible and supports Auto-fill My Return. It can also be used for simple tax returns and more complex returns.

Related: Learn what Canada RIT Payments from the CRA mean.

8. EachTax

EachTax is free for people in certain situations, including new customers, seniors over 70, new immigrants, and anyone with an income of $25,000 or under.

You will have to pay to use it if you do not meet one of these requirements. However, it is quite affordable, costing $6.99 for your first return and $3.99 for additional returns.

It includes auto-fill features and can be used for complex tax returns and simple returns. It also includes error-checking tools and is compatible with ReFILE.

You can use it online, so there is no need to download anything. It only offers email customer support, however.

It also includes Express NOA, so you can view your notice of assessment (NOA) in the software.

9. TaxTron

For user-friendly CRA-certified tax software, TaxTron is another option.

It takes you through the steps, so you just input the information required, and it claims to use 100% accurate calculations.

The application process even has video explainers embedded into it in case you get stuck.

It works on any browser, and there is no need to download any software. It’s also very quick and easy to use, and it claims you can file a nil tax return in as little as five minutes or under.

Use it to file a personal or corporate tax return, and it also offers both phone and email support.

What is Tax Software?

Tax software in Canada is software that makes the process of filing your tax return quick and easy, so you don’t have to hire an accountant.

When you use software, you don’t have to worry about all the changes in tax law because the software takes care of everything. Simply fill in the information requested and submit your return directly.

All software products have different features, but most products have step-by-step instructions to guide you through the process.

They also include features that speed it up, like the Auto-fill My Return feature that fills in information taken directly from the CRA.

Software should always be NETFILE compatible. This allows you to file your return online with the Canada Revenue Agency (CRA).

Pros and Cons of Tax Software

Here are the main advantages and disadvantages of using tax software to file your tax return:

Pros

- Tax software is usually quick, secure and easy to use.

- It allows you to follow a step-by-step guide to make the process easy.

- The software can import information from the CRA to speed up the process.

- Free versions are often available.

- Most will check for errors to reduce the chances of making a mistake.

- Some software comes with an accuracy guarantee.

- You can often save your information to speed up future returns.

Cons

- Sometimes free versions are only available in certain circumstances (e.g. for people on lower incomes).

- Software is not always available online, so you may have to download an application.

- Support may be limited for free versions.

- Software is not always suitable for more complex returns, but this depends on the product.

What to Look For in Tax Return Software

As we’ve discussed in this guide, there are lots of tax return software products. So, what should you be looking for?

- Is it free to use? It makes sense to save money by using a free version if possible.

- If it is free, what does it cover? Compare it with the paid version to decide which version you need.

- Ease of use. How easy is the process of filing a tax return? Does it have a step-by-step guide?

- Does it guarantee accuracy and include error checkers?

- Is it online, or do you have to download an application? Some may only be available for Windows computers, for example.

- Make sure it is NETFILE compatible.

Best Free Tax Software Comparison

| TurboTax | Wealthsimple Tax | H&R Block | StudioTax | UFileFREE | AdvTax | GenuTax | EachTax | TaxTron | |

| NETFILE compatible | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Auto-fill My Return | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Online or Download | Online | Online + Mobile App | Online | Download | Online & Windows | Online | Download (Windows Only) | Online | Online |

| Always Free | No | Yes | No | No | No | No | Yes | No | Yes (for personal returns) |

Canadian Tax Software FAQs

Is TurboTax actually free in Canada?

TurboTax is free to use in Canada. However, it is only free for simple tax returns. If you need more features, it also offers Deluxe and Premier versions.

How much does TurboTax Canada cost?

While TurboTax is free to use in many situations, it also offers paid versions. The Deluxe plan currently costs $20.99 per return, while the Premier plan costs $34.99 per return.

Which is better: Wealthsimple or TurboTax?

Both Wealthsimple Tax and TurboTax make filing tax returns in Canada easy. While TurboTax has a free version, Wealthsimple Tax is free even for more complex tax returns and only asks for a donation.

What is the difference between UFile and TurboTax?

Both UFile and TurboTax are tax return software products, and they both offer slightly different plans and features. They are both available online, with no need to download anything. While both offer free versions, UFile is always free for students.

Conclusion

Filing a tax return is never high on the list of fun weekend activities. But it is important, and you can save time, money and effort by choosing suitable tax return software.

All of the products in this guide can make the process of filing a tax return quick, easy and accurate.

If you don’t have a particularly complex tax situation, there’s a good chance you won’t need an accountant. So take your pick from the free tax software in this guide and take the hassle out of filing your next tax return.

Related: Find out the payment dates of Canada CRA Benefits.