File your taxes with 100% accuracy

Answer a few questions, autofill your return with tax slips from the CRA, and TurboTax does the rest to optimize your return.

Why TurboTax Online?

Simple tax returns are free

Have a simple tax situation? TurboTax Online has you covered. File your simple tax return for $0.

Easy-to-use tax software

Answer a few questions and TurboTax autofills your return with tax info directly from the CRA. 100% accurate calculations, guaranteed*.

Your maximum refund, guaranteed*

TurboTax finds every tax deduction and credit that you qualify for to boost your tax refund (or get you the lowest tax payable.)

Choose your TurboTax product

File your taxes online with confidence and accuracy.

TurboTax Online

Deluxe

Tax return optimized for donations, medical, and employment expenses

File your taxes online in a few easy steps

Step 1:

Answer a few questions about yourself

Answer a few simple questions about your tax situation and TurboTax will add the right forms to your return.

Step 2:

Import your tax slips

Autofill your return in minutes by importing your tax information directly from the CRA.

Step 3:

Find tax-saving opportunities

TurboTax searches for 400+ credits and deductions to ensure you get your maximum refund.

Step 4:

We double-check your work

TurboTax will review your work and flag any errors or missed opportunities before you file. Know that your taxes are done right with our 100% accurate calculations guarantee*.

Frequently asked questions

You don't really need anything but your email address to get started! Just answer a few simple questions and you're on your way. You don't even need to have your T-slips, we can import that information directly into your return from the CRA with Auto-fill my return.

Learn more about Auto-fill my return in TurboTax

For more complex tax situations, you may need additional documents or detailed financial information. But since we save your return as you go, you can always come back later to add these details anytime.

TurboTax works like an interview—we ask you easy–to–answer questions about your life that affect your tax situation (i.e., Are you married? Do you have kids?) and fill in all the right tax forms behind the scenes.

Our team of tax experts keeps our products up-to-date with the latest tax laws, so we know exactly what to ask. Your answers tell us which deductions and credits to look for, and what to ask next, so that we can find every dollar you deserve.

For example, if you tell us you have children, we'll help you claim child care expenses as a deduction. And if you're ever unsure about how to answer a question, we're here to help.

With TurboTax Online, you can connect with a TurboTax specialist and get real-time help with how to use our tax software. You can also visit:

TurboTax Support: TurboTax help articles, how-to video tutorials, and more.

TurboTax Hub: CRA tax news, tax saving tips, tax filing guides, the most up-to-date information on tax rates and benefits, and more.

TurboTax Community: 24/7 self-serve help forums with answers from TurboTax product specialists and other TurboTax users.

Need extra help? Simply upgrade to TurboTax Live Assist & Review to get unlimited guidance and advice from a live tax expert, whenever you want, via phone, email, or chat.

Simple tax returns include:

- Employment income

- Pension income

- Other employment income such as tips

- RRSP contributions

- Child care expenses

- COVID-19 benefits and re-payments

- Unemployment (EI) and social assistance

- Worker’s compensation

- Disability amount

- Worker’s benefit

- Amount for eligible/infirm dependants

- Tuition, scholarships, bursaries, grants, student loan interest

- Caregiver tax credit

- Disability transfer

- Home accessibility tax credit

- Tax on RESPs and RDSPs

- Tax installment payments

- Age amount

Income, credits, and deductions not listed above are not covered by TurboTax Free, including:

- Employment expenses (meals, lodging, etc.)

- Donations

- Medical expenses

- Investment income and expenses

- Rental property income and expenses

- Self-employed income and expenses

Yes. You can use TurboTax Online on any PC or Mac with a current web browser. You can also use the TurboTax mobile app for iOS and Android devices to do your taxes on your smartphone or tablet.

If you have direct deposit set up with the CRA, you will receive your refund within 8-10 days of filing.

If you don’t have direct deposit set up, it will take up to 6 weeks to receive a refund cheque by mail.

Yes, you can make changes to a tax return you filed with TurboTax by filing an adjustment through ReFILE.

Learn more about using ReFILE in TurboTax

Note: The Canada Revenue Agency (CRA) requires that you wait until you’ve received your Notice of Assessment (NOA) before filing an adjustment. In many cases, the CRA will catch the mismatch and automatically adjust your return for you. Learn more

Why customers love TurboTax

TurboTax has empowered over 1 million people.

“Very easy to use! This product makes filing tax returns easy and straightforward.”

CK, Ontario

“I truly can't believe I paid an accountant to do my taxes for over a decade. Wow. This software is life changing. So easy!”

Mariebelano, Toronto, Ontario

“Saved me money! The review/warning section of the return made me go from owing money to receiving money!”

MonaLisa, Montreal, QC

Includes reviews for TurboTax from previous years.

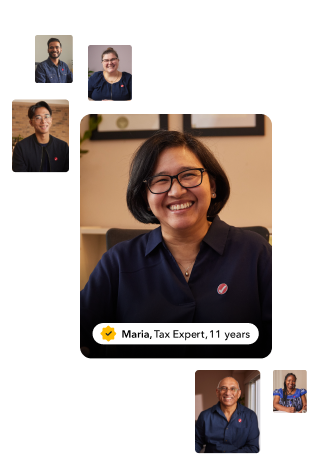

Real tax expert help, whenever you need it

Filing on your own? Get unlimited tax expert help and a final review with TurboTax Live Assist & Review. Want an expert to do your taxes from start to finish? We’ve got you with TurboTax Live Full Service.