Struggling with bad credit? Need cash fast? Discover the top lenders in Canada for those with bad credit.

Whether it’s urgent loans or guaranteed approval loans for poor credit, we’ve got you covered.

Read on to learn more and make the right choice.

Best Bad Credit Loans With Guaranteed Approval

1. Loans Canada

- Interest Rates: Range from 2.99% to 46.96%

- Loan Amount: Starts from $500 to $35,000

- Loan Term: From 4 to 60 months

- Minimum Credit Score: None

Founded in 2012, Loans Canada serves as a loan comparison platform, simplifying the search for personal loans with the best rates based on your credit score. They offer various loan types, including debt consolidation, auto financing, and business loans.

Borrowers can access up to $35,000, with terms extending up to 60 months. Loans Canada doesn’t charge platform fees, though lenders may have origination fees.

To apply, borrowers need to complete a short form on their website. After submission, the platform’s algorithm pairs borrowers with suitable lenders, resulting in pre-approval for a loan.

As soon as the agreement is reached, the lender’s website will provide further details, followed by funding within 1-2 business days.

Eligibility: You must be of the majority age in the province or territory where you live (i.e., at least 18 or 19 years old).

Pros

- You can utilize it to find the top unsecured personal loans

- It boasts an A+ rating with the Better Business Bureau (BBB)

- The platform offers free usage

- They offer competitive loan rates, with rates as low as 5.99% for unsecured loans and 4.99% for secured loans

Cons

- Does not directly offer loans

Check out our review of Loans Canada for in-depth details.

2. CarsFast

- Interest Rates: Ranges from 4.90% to 29.90%

- Loan Amount: Starts from $500 to $75,000

- Loan Term: From 12 to 96 months

- Minimum Credit Score: Good

CarsFast, an online car shopping platform in Canada, specializes in helping individuals with diverse credit backgrounds secure financing for their dream vehicles. With a presence in various provinces and territories, it has successfully assisted over 350,000 customers.

They collaborate with major financial institutions like TD, RBC Royal Bank, Scotiabank, CIBC, HSBC, and BMO Financial Group, along with partners like Envision Financial, Rifco National Auto Finance, and Valley First.

A subsidiary of LendingArch, CarsFast allows vehicle shoppers to compare car loans across Canada and choose the most suitable one. It was named one of Canada’s fastest-growing companies by The Globe and Mail in 2022.

Eligibility: You must have an annual income of at least $20,000, a three-month employment history, a valid Canadian driver’s license, and be a Canadian citizen over 20 years old.

Pros

- Receive quotes from various lenders, including major banks like TD, RBC, BMO, Scotiabank, CIBC, and HSBC.

- Speedy pre-approvals and financing: Get fast financing approval, often within a few days, depending on the lender and loan amount.

- Your loan doesn’t require a down payment or collateral.

- Enjoy flexible repayment terms, with some loans offering up to 96 months.

- CarsFast emphasizes income over credit scores.

- Access financing options from 350 dealerships across Canada.

- Trade-in your current vehicle, even if you still owe money on it, or use it as a down payment.

- Choose from a wide inventory of new and pre-owned vehicles.

- Complete the 5-minute application without creating an account.

Cons

- Financing can only be used for dealership vehicle purchases.

- You’ll receive quotes from a subset of lenders, potentially missing out on better rates.

- While CarsFast doesn’t charge fees, your chosen lender or dealership may have extra costs.

- High-interest rates if you have poor credit

- Lenders will need to conduct a credit check

3. LoanConnect

- Interest Rates: Ranges from 6.99% to 46.96%

- Loan Amount: Maximum of $50,000

- Loan Term: Stars from 3 to 120 months

- Minimum Credit Score: None

LoanConnect operates as a loan search engine in Canada, connecting borrowers with a variety of lenders. Founded in 2015, it collaborates with traditional banks, alternative lenders, and private lenders.

Borrowers can access loans of up to $50,000 for purposes such as debt consolidation, car purchases, medical expenses, and more. Interest rates, spanning from 6.99% to 46.96% APR, vary depending on the lender’s assessment of your creditworthiness.

Loan terms extend up to 10 years (120 months). Applying on their website takes only 5 minutes for pre-approvals, and funds can be disbursed on the same day.

Eligibility: Accepts applicants with various credit scores. To qualify, you need to be a Canadian citizen or permanent resident who has reached the age of majority in your province. Additionally, your total debt payments must not exceed 60% of your income.

Pros

- Use it to find top unsecured personal loans

- Boasts an A+ BBB rating

- It’s free to use

- Offers competitive rates: 5.99% for unsecured loans and 4.99% for secured loans

Cons

- Doesn’t offer loans directly

4. Borrowell

- Interest Rates: Range from 19.99% to 39.99%

- Loan Amount: Starts from $500 to $50,000

- Loan Term: From 6 to 60 months

- Minimum Credit Score: Good credit score required

Borrowell, a fintech company, offers access to online personal loans and a range of financial products. They were pioneers in providing free Equifax credit score checks.

Borrowell collaborates with multiple Canadian lenders, such as Fairstone, Symple Loans, LendDirect, and Refresh Financial. Loan interest rates vary, starting at 19.99% and going up to 39.99%, with loan terms spanning from 6 months to 5 years.

It’s important to note that some loans may have origination fees, potentially reaching up to 5%, so carefully review the loan details.

Eligibility: A good credit score of at least 660 is required. Additionally, you should have an annual income of at least $20,000 and no active bankruptcy or collection accounts.

Pros

- Offers competitive personal loans

- Provides additional financial products and tools, including free credit score checks

- Holds an A+ BBB rating

Cons

- Doesn’t directly offer loans

- Requires specific credit score and income criteria

- Certain loans come with high APRs and origination charges

Learn more about Borrowell in this guide.

5. Fairstone

- Interest Rates: Range from 19.99% to 39.99%

- Loan Amount: Varies between $500 and $50,000

- Loan Term: From 6 to 120 months

- Minimum Credit Score: Good credit score required

Fairstone, with nearly a century of operation in Canada, provides a range of personal financial solutions. Their offerings encompass secured and unsecured personal loans, mortgages, auto loans, and more.

For unsecured loans, you can borrow between $500 and $25,000, with interest rates spanning from 26.99% to 39.99%. The specific rate depends on factors like your credit score, borrowing history, and location.

Secured loans are available in amounts ranging from $5,000 to $50,000 and feature interest rates between 19.99% and 23.99%. It’s important to note that secured loans require your home as collateral.

It also offers diverse loan terms, ranging from 6 months to 10 years, contingent on the loan type you choose.

Eligibility: You must provide proof of income, such as your most recent pay stub or T4/T4a.

Pros

- A well-established and reputable company with a long history.

- Offers a quick and efficient approval process.

- Maintains a presence with branches throughout Canada.

- Holds an A+ rating with the Better Business Bureau (BBB).

Cons

- Interest rates tend to be relatively high.

- Secured loans may have penalties for early repayment.

- Please be aware that there could be extra fees involved.

Related: TransUnion vs Equifax Review

6. Mogo

- Interest Rates: Range from a low of 9.99% to a high of 46.96%

- Loan Amount: Borrowers can access loans starting at $500 up to $35,000

- Loan Term: Vary from a minimum of 9 months to a maximum of 60 months

- Minimum Credit Score: Doesn’t impose strict credit score requirements, but applicants are expected to have at least an annual income of $13,000

Established in 2008, Mogo is a prominent financial technology firm boasting over 1.8 million members and an array of financial products, including top-tier personal loans in Canada.

Mogo collaborates with partners such as Lendful and easyfinancial to offer these loans, featuring annual percentage rates (APRs) spanning from 9.9% to 46.96%. Applicants typically need a consistent yearly income of at least $13,000.

Upon application, pre-approval usually takes a mere 3 minutes. Some Mogo loans come with a unique 100-day test drive, allowing borrowers to return the principal within this period, with interest and fees waived if unsatisfied.

In addition to its loan products, Mogo extends its services to include a prepaid card, a stock trading platform, cryptocurrency trading, and identity fraud protection.

Eligibility: Mogo loans are available in BC, AB, ON, NB, MB, PE, NL, and NS. A minimum annual income of $13,000 is typically required.

Pros

- Provides multiple financial products

- Offers free credit score monitoring

- Holds an A+ BBB rating

- Offers a 100-day money-back guarantee for select loans

Cons

- High rates for poor credit

- Existence of negative Mogo reviews online

- Loans facilitated through Lendful and easyfinancial

7. EasyFinancial

- Interest Rates: Starts from 29.99%

- Loan Amount: Range from $500 to $20,000

- Loan Term: From 9 to 84 months

- Minimum Credit Score: For individuals looking for bad credit loans, the lender welcomes those with credit scores from 300 to 720

EasyFinancial, headquartered in Mississauga, ON, operates as a non-prime lending institution, specializing in unsecured personal loans, home equity secured loans, auto loans, and credit builder loans.

Established in 2006, this alternative lender caters to Canadians facing limited borrowing opportunities and exclusion from traditional lending establishments. EasyFinancial boasts over 400 physical locations across the nation, having assisted over 600,000 Canadians in securing financing.

In comparison to conventional banks, EasyFinancial adopts a more inclusive approach, extending approval to a broader spectrum of clients, including those with tarnished credit histories. The alternative lender conducts a comprehensive evaluation of a borrower’s financial profile, often resulting in a higher approval rate compared to traditional lenders.

Eligibility: You must be a Canadian citizen, meet your province’s minimum age requirement, show your ability to make payments, and have a steady income of at least $1,200 per month.

Pros

- Easy, secure online application with fast approval within 1 business day

- Open to all, including newcomers, students, and those with poor or no credit history

- Accessible support through online, in-person, or telephone channels

- High approval rate, accommodating many with bad credit who were declined by banks

- No-cost application that doesn’t impact your credit score

- Available throughout Canada, serving all provinces and territories

Cons

- High interest rates for bad credit, reaching up to 46.96%. Even unsecured loans begin at a relatively elevated 29.99%

- Possibility of extra costs, encompassing administrative fees, non-sufficient funds charges, and penalties for late or missed payments

- Lack of online quotes or tools for convenient comparison shopping

8. Loan Away

- Interest Rates: Range from 19.99% to 45.9%

- Loan Amount: Starts from $1,000 to $5,000

- Loan Term: From 6 to 36 months

- Minimum Credit Score: None

Loan Away, in business since 2015, offers fast access to personal loans for individuals with bad credit, often granting approvals within just 30 minutes of submitting an online application.

Borrowers can access up to $5,000, with interest rates ranging from 19.99% to 45.9%. Notably, the company maintains a remarkable approval rate, with over 80% of applications being accepted.

Eligibility: To apply, you’ll need two government-issued IDs, proof of income, Canadian residency, and be at least 18 years old.

Pros

- Access installment loans up to $5,000 with bad credit

- Enjoy a high approval rate

- Holds an A+ BBB rating

Cons

- Operates in select provinces: ON, AB, NB, BC, NS, and NL

- The top loan rate goes up to 45.9%

- The highest loan amount is $5,000

9. Marble

- Interest Rates: Range from 18.99% to 24.99%

- Loan Amount: Starts from $5,000 to $15,000

- Loan Term: From 36 to 84 months

- Minimum Credit Score: 300

MyMarble is a financial wellness platform harnessing AI for tailored recommendations and actionable plans. It was founded in 2016 by a team of financial technology specialists dedicated to empowering Canadians and improving their financial well-being

With their AI-enabled platform, you can use different tools and get personalized advice to help you achieve your financial goals. Depending on your distinct financial path and objectives, you have the choice of the MyMarble Community (free) or MyMarble Premium Plan (paid).

Marble Financial also provides a FastTrack loan program aimed at helping individuals exit consumer proposals quickly, with the goal of achieving debt-free status within 24 months, improving credit scores, and securing a better financial future. Please refer to the following for more details:

Eligibility: You will need to:

- Be at the age of majority in your province (usually 18-19+)

- Have proof of steady employment and income (paychecks, etc.)

- Have at least 12 months of good repayments listed on your credit history

- Have recent bank statements

- Have your proposal’s schedule and payout details (from an Insolvency Trustee)

Pros

- Exit your consumer proposal

- Rapidly improve credit score by 30 to 70 points

- Competitive rates in comparison to bad credit personal loans

Cons

- Legal and administrative fees

- Elevated interest rates (where consumer proposals have no interest charges)

10. 514Loans

- Interest Rates: Range from 22.00% to 32.00%

- Loan Amount: Starts from $300 to $3,000

- Loan Term: From 90 to 120 days

- Minimum Credit Score: None

514 Loans, headquartered in Montreal, extends short-term loans throughout the country via its network of lending partners. These loans, which can go up to $3,000, serve as an alternative to payday loans, offering greater affordability and flexibility, according to the company’s website. Notably, they do not conduct credit checks.

Since its establishment in 2017, they have helped over 56,000 customers, with an impressive 94% expressing satisfaction with their services.

Moreover, you can conveniently apply for these loans online, eliminating the need for in-person visits and ensuring a quick and secure application process that typically takes just a few minutes.

Eligibility: You must be a Canadian citizen, aged 18 or older, employed full-time, maintain an active bank account, and not currently be involved in a consumer proposal or bankruptcy proceedings.

Pros

- More flexible installment loans compared to traditional payday loans

- No credit checks needed

- Collaborates with licensed lenders

- Allows clients to customize their repayment schedules

- Self-employed individuals can also get approved

- Lower APR for installment loans than payday loans

- Available across Canada

Cons

- Membership fee applies

- $50 NSF fee and $35 fee for repayment rescheduling or term extension

- No consecutive rescheduling of two payments

- Maximum of two payment reschedules per loan term

- Extended payment schedules for loans exceeding $1,000

11. SkyCap Financial

- Interest Rates: Range from 12.99% to 39.99%

- Loan Amount: Goes from $500 to $10,000

- Loan Term: From 9 to 60 months

- Minimum Credit Score: None

Founded in 2013, SkyCap Financial is a lender specializing in quick personal loans for various purposes such as car expenses, weddings, dental bills, education, home improvements, travel, and more.

These loans come with interest rates ranging from 12.99% to 39.99%, offering borrowers access to amounts up to $10,000.

Flexible loan terms are available, ranging from 9 to 36 months, providing options to fit individual financial preferences.

Eligibility: You must have a monthly income of $1,600 or higher, along with meeting the legal age of adulthood in your province of residence.

Pros

- Provides bad credit personal loans for those with low or poor credit

- Offers a fast and streamlined application process

- Holds an A+ BBB rating

- Access to educational resources by way of SkyCap Financial University

Cons

- Loans are capped at $10,000

- APR ranges from 12.99% to 39.99% for applicants with bad credit

12. Magical Credit

- Interest Rates: Range from 19.99% to 46.8%

- Loan Amount: Starts from $1,500 to $20,000

- Loan Term: From 12 to 60 months

- Minimum Credit Score: None

Magical Credit has been helping Canadian consumers secure fast and straightforward short-term personal loans since 2014.

They provide personal loans of up to $20,000, regardless of the borrower’s previous financial challenges or credit history. They specialize in serving individuals with low incomes and poor credit scores.

Eligibility: You must be at least 18 years old, possess a valid Canadian ID, and maintain an active bank account with direct deposit from your employment or subsidy. Additionally, you should not be currently undergoing bankruptcy, a consumer proposal, or debt consolidation.

Pros

- Offers larger loan amounts compared to many subprime lenders

- Provides a safer and more affordable alternative to payday loans

- Does not require collateral for loan approval

- No charges for early loan repayment

- Timely payments can improve your credit score and enhance your credit report

Cons

- Interest rates could be higher than those of traditional secured or unsecured loans

- Loan terms cannot be extended or automatically renewed

- NSF (non-sufficient funds) may result in penalty fees

- Not available in Manitoba, Quebec, or Saskatchewan

- Defaulted payments may result in penalties and a decrease in your credit score

13. FlexMoney

- Interest Rates: Range from 18.9% to 46.9%

- Loan Amount: Starts from $500 to $15,000

- Loan Term: From 6 to 60 months

- Minimum Credit Score: 500

FlexMoney, headquartered in Toronto, also provides online personal loans to residents of other provinces, from Alberta to the Yukon.

Established in 2012, they deliver speedy loans through their user-friendly online application and funding process. With over a decade of experience, FlexMoney is a reputable Canadian lending company and proudly holds accreditation from the Better Business Bureau (BBB).

Eligibility: Minimum income of $2,000 a month and must be more than 3 months either employed, self-employed, or receiving government assistance.

Pros

- Quick online application with fast pre-approvals

- Consider applicants receiving government assistance or those who are self-employed

- Maximum loan amount up to $15,000

- Flexible loan terms from 6 to 60 months to adjust your monthly payments as needed

- Convenient repayment options like weekly, fortnightly, or monthly repayments

Cons

- High-interest rates start at 18.9%, but rates can climb to 46.9%

- Credit check is mandatory

- No online quotes or comparisons

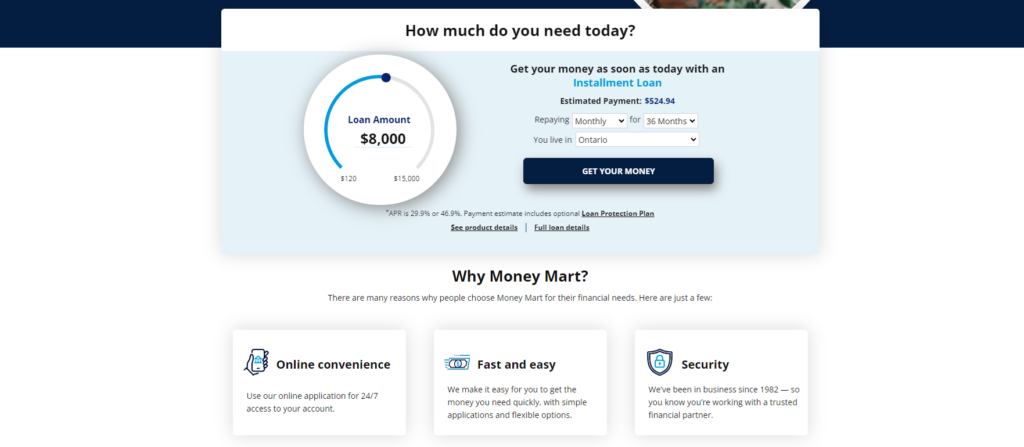

14. Money Mart

- Interest Rates: Ranges from 29.9% to 46.9%

- Loan Amount: Starts from $500 to $15,000

- Loan Term: From 6 to 60 months

- Minimum Credit Score: None

Money Mart is a prominent alternative lender specializing in loans for individuals with fair to poor credit.

With a presence both online and through 500+ store locations across Canada, Money Mart has been serving customers since its establishment in 1979, with its headquarters situated in Malvern, Pennsylvania

Eligibility: You need to be at least 19 years old, have an active chequing account, and have a steady source of income.

Pros

- Access payday loans and installment loans

- Enjoy quick approval and funding

- Established lender

Cons

- High-interest rates

- Availability differs between in-store and online, varying by province

15. Prudent Financial

- Interest Rates: Range from 6.99% to 56.5%

- Loan Amount: Up to $500,000

- Loan Term: From 12 to 60 months

- Minimum Credit Score: None

Prudent Financial, based in Toronto, focuses on providing loans for individuals with poor credit. It extends home equity and car title loans to residents of Ontario, with previous bankruptcies or consumer proposals not hindering loan eligibility.

Although it lacks accreditation from the Better Business Bureau (BBB), it holds a commendable A+ BBB rating.

Eligibility: For home equity loans, you need to possess at least 50% equity in your home. For vehicle title loans, you must own a paid-off vehicle that is either 6 years old or newer, or alternatively, an older luxury vehicle.

Pros

- Well-established lender

- Quick approval process

- Accepts applicants with bad credit

- Proof of income not needed

Cons

- Loan features not clearly defined

- High APRs

- Be mindful of applicable loan fees

- Limited availability in Ontario

16. Blue Copper Capital

- Interest Rates: Ranges from 14% to 48%

- Loan Amount: Starts from $100 to $500,000

- Loan Term: From 6 to 36 months for installment loans. 42 to 62 days for payday loans

- Minimum Credit Score: None

Blue Copper Capital, headquartered in Calgary, Canada, provides short-term loans without the need for a credit check. It was established in 2006 and has grown to offer loans ranging from $100 to $500,000.

Eligibility: You must be employed for at least 90 days, have a preauthorized debit agreement to show your banking history, be at least 18 years old, and be a resident of Alberta or BC.

Pros

- Excellent customer service

- No credit checks needed

- Availability of fast cash

Cons

- Gainful employment and an active bank account are mandatory

- Interest is on the high end

17. Lend for All

- Interest Rates: Range from 9.9% to 46.93%

- Loan Amount: Starts from $100 to $50,000

- Loan Term: From 6 to 120 months

- Minimum Credit Score: 300

Lend for All, an online broker established in 2018, specializes in connecting borrowers across Canada with partner lenders offering various loan types, including personal, car, business, mortgage, and debt consolidation loans.

Whether you have good or bad credit, including consumer proposals or bankruptcy, they strive to find suitable lenders for your needs.

Eligibility: You must be a Canadian citizen or permanent resident, 18 years of age or older, willing to undergo potential credit checks (required by partner lenders), and able to provide proof of income for repayment assessment.

Pros

- You may receive multiple offers

- Diverse loan options

- Bad credit applicants accepted

Cons

- Acts as an online intermediary (not a direct lender)

- Works with a select group of lending partners

- Many partner lenders offer unsecured loans with rates exceeding 20%

18. Progressa

- Interest Rates: Range from 19% to 46.95%

- Loan Amount: Starts from $1,000 to $15,000

- Loan Term: From 6 to 60 months

- Minimum Credit Score: None

Progressa, established in 2013, is a Canadian company recognized in the 2018 Fintech 250 by CB Insights for its fintech innovations.

While serving over 30,000 Canadians, it focuses on debt consolidation services. Progressa operates nationwide, excluding Quebec, with a mission to help individuals regain control of their finances through consolidation.

Eligibility: You need to be a Canadian citizen, aged 18 or older, earning a monthly net pay of at least $1,000, and have been employed with your current job for a minimum of 31 days.

Pros

- Rapidly growing Canadian financial startup with A+ BBB accreditation

- User-friendly website for straightforward applications and speedy 1-2 day approvals

- Offers two convenient funding methods: direct deposit and direct payment to the lender

- Transparent information is available on their website

- There are no NSF fees if you inform the company of repayment challenges

Cons

- Not available in Quebec

- Requires a co-signer for customers with a history of bankruptcy, even those who have discharged it

19. Spring Financial

- Interest Rates: Range from 9.99% to 46.96% (Personal Loan) and 18.99% (Evergreen Loan)

- Loan Amount: Starts from $500 to $35,000 (Personal Loan), $1,500 (Evergreen Loan)

- Loan Term: From 6 to 60 months (Personal Loan), 12 months (The Foundation), and up to 18 months (Evergreen Loan)

- Minimum Credit Score: 500

Spring Financial is an online alternative lender established in 2015, catering to individuals with fair or poor credit across Canada. Their primary offerings include personal loans and credit builder loans, known as “The Foundation”.

Eligibility:

- Minimum monthly income of $1,800, with at least 3 months of employment

- Proof of legal age in your province or territory

- Verification of employment status and monthly income, usually through pay stubs or bank statements

- Valid Canadian ID for identity, address, and contact information

- Active Canadian bank account with direct deposit functionality

- Credit report, including your credit score

- Personal references and a workplace contact for employment verification

Pros

- A fully online process

- Well-established lender

- No fees for early repayment

Cons

- High-interest rates for individuals with poor credit

- Possibility of being offered a credit builder loan instead of a personal loan

20. 24Cash

- Interest Rates: 22% plus Broker Fee

- Loan Amount: Starts from $500 to $850

- Loan Term: 90 to 150 days

- Minimum Credit Score: None

24Cash.ca, based in Toronto, is an online personal loan broker facilitating connections between borrowers and lenders providing short-term installment loans. It serves most Canadian provinces, offering a user-friendly online or phone-based application process.

Eligibility:

- Age 18 or older

- Canadian citizenship

- Minimum three months of steady employment

- Monthly income of at least $1,200

- Active Canadian bank account for three months

- No current or planned bankruptcy

- Low short-term debt ratio

Pros

- No mandatory credit checks

- Longer repayment terms than payday loans

- Quick access to funds

Cons

- Maximum $500 loan for first-time borrowers

- High borrowing costs

21. Fast Access Financial

- Interest Rates: Varies from 9.90% plus the applicable application fee. APR’s are from 15.75% to 58.99%

- Loan Amount: Starts from $1,000 to $5,000

- Loan Term: From 12 to 36 months

- Minimum Credit Score: 300 (recommended)

Fast Access Financial is an alternative lender founded in 2008 in Ontario, Canada. They offer secured and unsecured loans as well as mortgages, catering to individuals who may not qualify for traditional bank loans or prefer alternative lending options.

Eligibility:

- Minimum 6 months of full-time employment (at least 35 hours per week)

- Age verification of at least 21 years

- A valid checking account with direct deposit capability

- Proof of permanent Canadian residency

Pros

- Quick and easy approval

- Flexible repayment terms and interest rates

- Various products and loan amounts are available

- Responsible payments can positively impact your credit score

Cons

- Potentially high interest rates

- Missed payments may harm your credit and incur penalty fees

- Defaulting on a secured loan could lead to collateral loss

- Administrative fees may not be transparent initially

22. PYLO

- Interest Rates: Range from 15.99% to 39.99%

- Loan Amount: Starts from $500 to $15,000

- Loan Term: From 6 to 60 months

- Minimum Credit Score: None

Pylo Finance is a lender that focuses on providing larger loans with extended terms, assessing eligibility beyond just credit scores. They aim to alleviate the borrowing process’s stress by crafting personalized repayment plans to meet your specific needs.

Eligibility: You need to reside in one of the provinces where we offer our services (BC, Alberta, Ontario, Manitoba, and Newfoundland & Labrador), be of the age of majority in your province, and have employment or retirement income.

Pros

- Approval process also involves creating a personalized financial repayment plan

- Focus on making borrowing less stressful and tailoring solutions to meet your needs

- Offer larger loans with longer terms, competitive rates, and transparency without hidden fees.

Cons

- Prerequisites include providing 12 months of bank statements

- Don’t extend loans to individuals currently in credit counselling, consumer proposals, or bankruptcy

23. Tribecca Finance

- Interest Rates: They claim to offer the lowest interest rates, but this is not specified on their website.

- Loan Amount: Depends on the type of loan

- Loan Term: Not specified

- Minimum Credit Score: Not specified

Tribecca Finance, headquartered in Toronto, Canada, is a leading lending company known for its diverse range of lending products, including home equity loans, personal loans, construction loans, first mortgages, and second mortgages.

With a swift approval process, they ensure quick access to funds, aiming to enhance the borrowing experience.

Eligibility: Not specified. You may check with them directly via their website or phone number at (416) 225-6900.

Pros

- Provides speedy access to funds as a direct lender

- They claim to offer the lowest interest rates in alternative lending

- Straightforward application process with same-day approval

- Provides flexible guidelines and personalized financial solutions

- Friendly and professional customer service team

Cons

- Mainly offers secured personal loans, requiring collateral like property, which may not suit those without assets.

- Specializing in home equity loans, personal loans, construction loans, first mortgages, and second mortgages, they may not cover all loan categories.

Best Loans for Bad Credit in Canada Summary – Top 10

Here’s a summary of the top 10 lenders offering bad credit loans in Canada. For more details, scroll back up to explore each lender’s unique offerings.

| Lender | Interest Rate | Loan Term | Loanable Amount |

| Loans Canada | 2.99% – 46.96% | 4 – 60 months | $500 – $35,000 |

| Cars Fast | 4.9% – 29.9% | 12 – 96 months | $5,000 – $75,000 |

| LoanConnect | 6.99% – 46.96% | 3 – 120 months | $500 – $50,000 |

| Borrowell | 19.99% – 39.99% | 6 – 60 months | $500 – $50,000 |

| Fairstone | 19.99% – 39.99% | 6 – 120 months | $500 – $50,000 |

| Mogo | 5.99% – 46.96% | 9 – 60 months | $500 – $35,000 |

| EasyFinancial | 19.99% – 46.93% | N/A | Up to $15,000 |

| Loan Away | 19.99% – 45.9% | 6 – 36 months | $1,000 – $5,000 |

| Marble | 18.99% – 24.99% | 36 – 84 months | $5,000 – $15,000 |

| 514Loans | 22.00% – 32.00% | 90 – 120 days | $300 – $3,000 |

Methodology

When checking the top personal loans available to Canadians, we take into account many factors, including:

- APR or interest rates

- Loan repayment terms

- Available loan types

- Loan amounts

- Application procedures

- Customer support and user reviews

- Business ratings

Every loan provider or comparison platform has its own distinct features, and we have conducted research on the most widely used ones. If you’re interested in loans from banks that do not disclose their rates online, you will need to reach out to them directly to request a quote.

What is a Bad Credit Loan?

A bad credit loan in Canada is a type of personal loan offered to individuals who have a poor credit score. Traditional lenders only approve loans for those with a good credit score, typically 660 or above.

If your score falls within the 550-650 range or even lower, alternative lenders become a more viable option for personal loans. But, these lenders tend to charge higher interest rates on bad credit loans due to the higher risk that they assume.

How to Apply For a Bad Credit Loan

Applying for a bad credit loan doesn’t have to be a complicated process. Here are the simple steps to securing a loan, even with bad credit:

- Research: Explore the lenders listed in this guide and choose one that suits your needs.

- Gather Documents: Prepare necessary documents, including proof of income, identification, and financial statements.

- Submit Application: Complete the lender’s online application form.

- Review Offers: Once approved, carefully review the loan terms and interest rates.

- Accept Loan: If the terms are favourable, accept the loan, and funds will be deposited into your account.

Related: Best Credit Cards For Bad Credit

Pros and Cons of Loans for Bad Credit

Like any financial product, bad credit loans come with their own set of advantages and disadvantages.

Pros

- Access to funds, even with a low credit score

- Opportunity to rebuild credit

- Flexible repayment terms

- Various lenders to choose from

Cons

- Higher interest rates

- Potential for predatory lending practices

- Limited loan amounts

- Stricter eligibility criteria

What to Look For in a Bad Credit Loan

When considering a bad credit loan, a number of factors should guide your decision. Among these are:

- Interest Rates: Compare rates from different lenders and choose the most competitive one.

- Loan Amount: Ensure the loan amount covers your needs without overextending your finances.

- Repayment Terms: Opt for terms that align with your budget and financial goals.

- Customer Reviews: Research customer experiences and reviews to gauge the lender’s reputation.

- Eligibility Criteria: Verify that you meet the lender’s requirements before applying.

- Additional Fees: Be aware of any hidden fees or charges associated with the loan.

FAQs

What are the easiest loans to get with bad credit?

Some lending platforms, like Loans Canada and LoanConnect, cater to borrowers with bad credit, making the application process more accessible.

Can you get a loan with a credit score of 550?

Yes, a number of lenders in Canada offer loans to individuals with credit scores as low as 550.

What is the lowest credit score for a loan?

The minimum credit score requirement varies among lenders, but some offer loans to individuals with scores as low as 300.

Where can I borrow money instantly?

Providers of bad credit loans typically offer swift approval and funding, with the possibility of obtaining a personal loan in as little as 24 to 48 hours. Some of these lenders are Loans Canada and LoanConnect.

Related: