Whenever you apply for a loan or credit card, lenders will check your credit score. They do this using one or both of the credit bureaus in Canada: TransUnion and Equifax.

But what exactly are these two credit bureaus? And what are the differences between them?

In this guide, we look at Equifax and TransUnion in Canada, including their differences, the services they both offer, and how you can check your credit score using both.

What Are Credit Bureaus?

Credit bureaus, sometimes called credit reporting agencies, gather information about your situation to determine how much of a risk you present to lenders.

For example, when you use a credit card, if you make your monthly payments on time, this information is sent to the credit bureaus. Likewise, this information is also sent if you fail to make a payment.

The credit bureaus then add this information to your credit report, and from this, they give you a credit score.

Your credit score essentially shows your creditworthiness. If you have a high score, lenders are more likely to lend you money because it suggests you are reliable at repaying your loans on time.

If you have a poor or bad score, on the other hand, the opposite is true. In this case, you may not be able to get a new credit card or loan.

As such, credit bureaus are very important. Your credit rating at the two bureaus can have a big impact on how much credit you can access and the cost of that credit.

Equifax Credit Score

When you find out your credit score from Equifax, it will be a three-digit number ranging from 300 to 900. 300 is the lowest score you can get, and 900 is the highest.

Equifax Canada gathers data about your credit and then creates a credit report for you and uses information in this report to calculate your score.

It has relationships with banks and other lenders and gathers public information. For example, it gathers information on your open accounts, how much you owe, your total credit and more.

TransUnion Credit Score

TransUnion Canada also provides you with a credit score from 300 to 900. It uses similar information as Equifax, including public information and that provided by banks and lenders.

However, it may gather information from different lenders than Equifax at different times. As a result, the credit score calculation is also slightly different.

For these reasons, if you get your credit score from TransUnion and Equifax, you may find the scores slightly different.

How Are Credit Scores Calculated?

Credit scores are taken from the information in the credit report, and several factors go into calculating them.

One of these is your loan repayments. When you make payments on time, this is good for your score. Late payments, on the other hand, or missed payments can negatively impact your score.

Another factor is credit utilization. This is the amount of available revolving credit that you are using.

Let’s say you have two credit cards, and each has a credit limit of $2,000, giving you access to a total of $4,000 of credit. However, you are only using $400 of that. In this case, you would be using 10% of your available credit.

It’s a good idea to try and stick to a credit utilization of under 30% to help improve your credit score.

The number of credit inquiries you make can also have an impact. For example, applying for lots of credit cards in a week could hurt your score.

Other factors that may impact your credit score are your credit history, the number of loans you have, and the types of loans you have.

Public records are also used. For example, if you file for bankruptcy, this will hurt your credit rating.

Credit scores fluctuate, and they can differ between the two bureaus. In addition, not every lender reports to both credit bureaus, and they both have different scoring models, so your credit score may differ depending on where you check it.

Related: Best personal loans in Canada.

Who Gives a More Accurate Credit Score: TransUnion or Equifax?

The simple answer is that neither Equifax nor TransUnion are more accurate than the other.

Both bureaus use different models and algorithms to determine credit scores, but they are both accurate and based on similar factors, as described above.

For example, one may give your payment history more prominence in its scoring model, while one may give more weight to credit utilization than the other.

Neither credit bureau is more important than the other. Lenders choose the agency they want to use, and you often don’t know which agency they will check.

One thing to check for, however, is mistakes in your credit report. They do happen, and this is possible with either credit bureau.

If you check both bureaus and one is very different, check for mistakes. It could be due to identity theft or a more simple reason, and you will want to get any mistakes rectified.

Is TransUnion or Equifax More Popular?

Regarding getting a TransUnion credit score vs Equifax, neither credit bureau is more popular than the other. It all depends on the lender; while some choose TransUnion, others choose Equifax.

In terms of your credit score, it’s best to consider both. Check both regularly, and then it doesn’t matter which credit bureau lenders use when deciding whether to approve your loan or credit card application.

Equifax vs TransUnion Offerings

Both Equifax and TransUnion have several product offerings for users:

Equifax

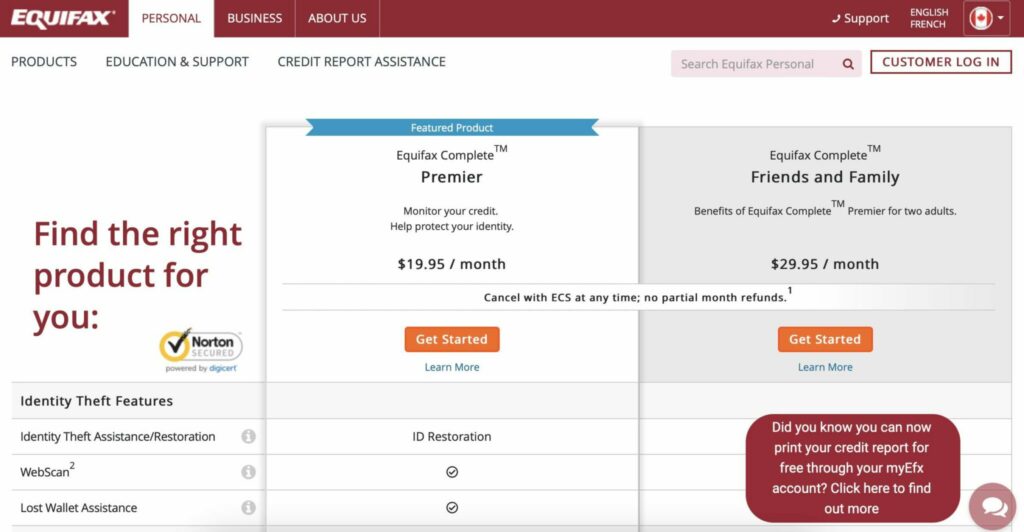

Equifax has two monthly subscriptions for personal use.

- Premier – $19.95 per month

- Friends and Family – $29.95 per month

Both are the same, apart from the fact that the Friends and Family subscription is for two adults instead of one.

Once you subscribe, you can get daily access to your credit score and report and ID theft insurance.

It also has an Education section to learn about credit scores and reports. Businesses can also access many business offerings, including 79 products and 10 solutions.

TransUnion

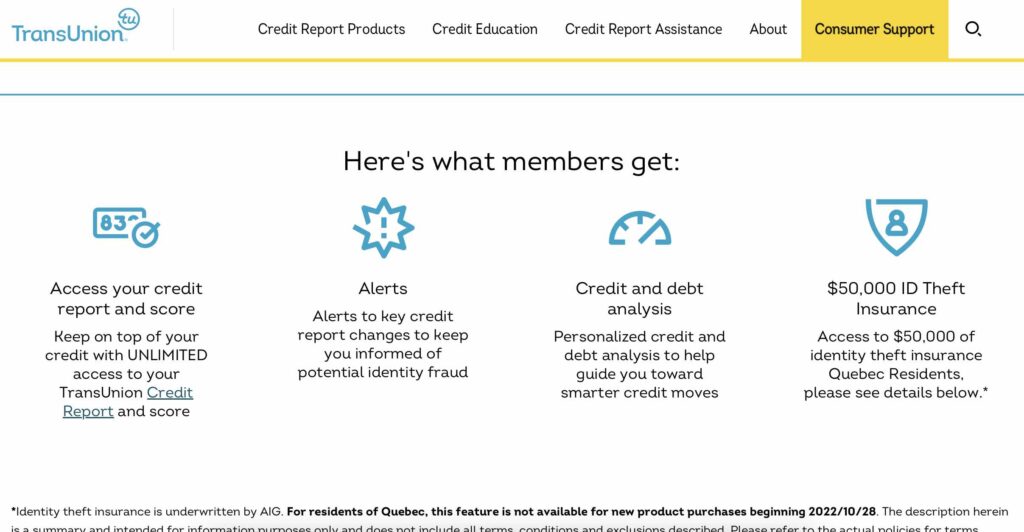

You can sign up for a monthly subscription at TransUnion to get your credit report. For $24.95 per month plus tax, you will get the following:

- Unlimited access to your credit report and score

- Alerts to changes in your score

- Personalized credit and debt analysis

- ID theft insurance up to $50,000

You can also get a free Consumer Disclosure, which contains all the information in your credit report, and there are lots of guides on topics like credit monitoring, reports, ID theft, etc.

Credit Report assistance is also available for disputes and fraud victims, and there is a wide range of products and solutions for businesses and industries.

How to Check Your Equifax Credit Score

It’s always a good idea to check your credit score regularly to know how it is changing and whether it is improving or getting worse.

This is especially important if you plan to apply for a loan to give you a better idea about whether you will be accepted before applying.

If you have a poor credit score, you can do something about it by working to improve it, so you can improve your access to credit in the future.

The first option is to check your score with Equifax directly. As mentioned previously, this is a paid service, and you will need to pay $19.99 per month to access your credit report.

If you want to check it regularly, you must pay monthly. But if you want to go straight to the source and take advantage of other benefits like ID theft insurance, you may want to use this.

Another option is to use a free service, and one of the best is Borrowell.

You can sign up for a free account to get weekly access to your credit score as well as report monitoring and credit improvement tips.

It does not hurt your score to check it with Borrowell, and it also provides product recommendations based on your credit profile.

How to Check Your Transunion Credit Score

TransUnion offers TransUnion Credit Monitoring for $24.95 per month, as mentioned above. This is similar to Equifax, and you will get detailed information on your credit report and score.

Again, you have alternative options where you can check your credit score for free, like Credit Karma.

Here, you can get a free credit score check, credit reports, credit monitoring, and access to education about credit.

FAQs

Do banks look at TransUnion or Equifax?

When banks and other lenders want to check your credit score, they may check TransUnion, Equifax or both. Often, you will not be aware of which one they prefer to check, and it is out of your control.

Do car companies look at TransUnion or Equifax?

If you are applying for a car loan, the company providing the loan will check either TransUnion or Equifax or both to determine your creditworthiness. They use this information to decide whether to provide you with a loan and how much interest to charge you.

Which lenders use Equifax only?

It’s hard to say which lenders only use Equifax. Some may use just Equifax or use both credit bureaus. You can always try inquiring about this with the lender before you apply for a loan.

Related: Best payday loans in Canada