The Tangerine World Mastercard is a popular cashback credit card in Canada. It allows users to earn up to 2% cash back on specific spending categories and 0.5% cash back on all other purchases.

It has no annual fee and comes with many great perks that make it a popular choice.

But is it the right credit card for you? What are the specific benefits you can expect from it?

Here’s everything you need to know about the Tangerine World Mastercard so you can decide whether to apply for it.

Tangerine World Mastercard At a Glance

The Tangerine World Mastercard is a popular credit card used to earn cashback in Canada.

It’s one of two credit cards that Tangerine offers, and it is very similar to the Tangerine Money-Back Credit Card. It includes all the same benefits as the more basic card, but it has a few extra perks and features that make it stand out.

Here are the main details you need to know about the Tangerine World Mastercard:

- Earn 2% cash back on purchases in up to three categories

- Earn 0.5% cash back on other purchases (unlimited)

- $0 annual fee

- APR 19.95% on purchases and cash advances

- 3% balance transfer fee (minimum $5)

- 2.5% FX conversion fee

Tangerine World Mastercard Top Features

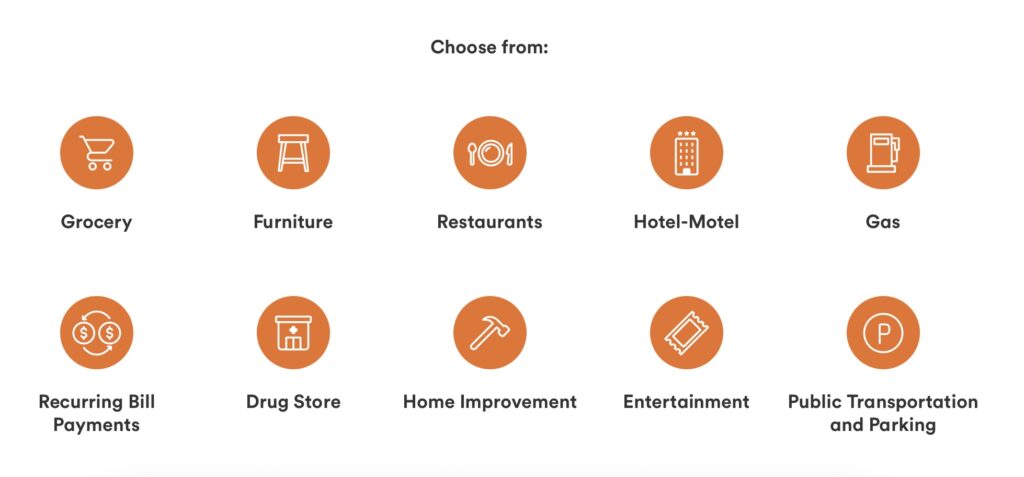

The Tangerine World Mastercard’s main feature is users’ ability to earn up to 2% cashback on their purchases.

To earn the maximum 2% cashback, you can choose two spending categories, including groceries, gas, restaurants, and more.

You will earn 0.5% cash back for all other purchases, and there is no limit on the amount you can earn at this rate.

You can also have your cashback rewards deposited into a Tangerine Savings Account. If you do this, you can add a third category to earn 2% cashback on top of the two you already have.

Tangerine currently runs a welcome bonus where you can earn an additional 10% cashback in the first two months up to $1,000 (valued at $100).

If you want to transfer a balance, you can enjoy a low-interest rate of 1.95% on balance transfers for six months as long as you transfer within 30 days of opening your account.

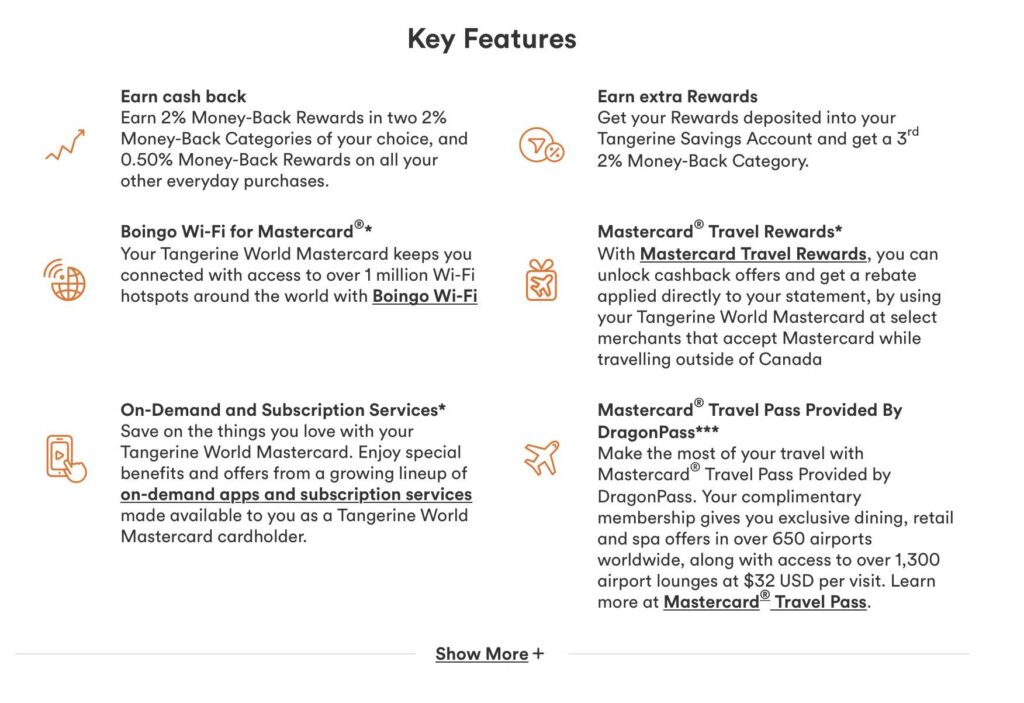

Other Tangerine World Mastercard benefits include additional perks not provided by the Tangerine Money-Back Credit Card. These include Mastercard Travel Rewards membership, where you can take advantage of various cashback offers by using the card when travelling internationally.

You also get complimentary membership to Mastercard Travel Pass, where you can enjoy offers in over 650 airports and visit over 1,300 airport lounges globally for USD 32 per visit.

You can also access Boingo WiFi for Mastercard, which provides free WiFi at over a million hotspots worldwide.

Tangerine World Mastercard mobile device insurance and rental car insurance are included but check the small print to find out exactly how much is covered in your situation.

You can also enjoy the benefits of on-demand apps and subscription services where you can save while using the card.

Finally, if you want to add authorized users, you do not have to pay for additional cards.

Downsides of the Tangerine World Mastercard

There are not too many downsides to the Tangerine World Mastercard. However, the most notable is the high-income requirement.

The Tangerine World Mastercard requirements state that you need a personal income of $60,000 or a household income of $100,000, which may make the credit card unavailable for many people.

Bear in mind that this card does not provide significantly more than the Tangerine Money-Back Credit Card apart from the extra travel perks and insurance.

However, the Tangerine Money-Back Credit Card has a much lower income requirement of just $12,000, so this could be a more suitable option.

How to Apply for the Tangerine World Mastercard

Applying for the Tangerine World Mastercard is straightforward as long as you are eligible.

As stated above, you must have a gross annual income of $60,000 or a household income of $100,000 to apply. Alternatively, you can hold $250,000 or more in Tangerine Savings Accounts.

You will also need to be a permanent resident of Canada and be clear of bankruptcies for seven years.

If you meet all the requirements, you can apply online by creating an account with Tangerine.

Alternatives to the Tangerine World Mastercard

There are several alternatives to the Tangerine World Mastercard that you might want to consider. Here are a few of the top cards compared:

Tangerine World Mastercard vs Tangerine Money-Back Credit Card

The Tangerine Money-Back Credit Card is very similar to the Tangerine World Mastercard, and it has the same benefits in terms of cashback. It has the same $0 annual fee, and the APR is the same for purchases and cash advances.

However, it does not come with extra insurance and the same travel benefits. As such, the minimum income requirement is lower at just $12,000.

Read our detailed review of the Tangerine Money-Back Credit Card.

Tangerine World Mastercard vs BMO CashBack Mastercard

The BMO CashBack Mastercard has no annual fee and an APR of 20.99% for purchases and 22.99% for cash advances.

You can earn cashback of up to 3% on groceries, 1% on recurring bill payments, and 0.5% on all other purchases, and you can redeem cashback at any time.

You can also enjoy a few other perks, including 25% off car rentals.

Tangerine World Mastercard vs Simplii Financial Cash Back Visa Card

The Simplii Financial Cash Back Visa Card also has no annual fee. The APR is 19.99% for purchases and 22.99% for cash advances, with a minimum household income requirement of $15,000.

With this card, you can earn up to 4% cash back for purchases at restaurants, bars, and coffee shops with a $5,000 annual limit.

You can earn 1.5% cash back on gas and groceries with a $15,000 annual limit and 5% on everything else with no limit.

You can also add up to three additional cardholders with no annual fee.

Learn more about Simplii Financial Cash Back Visa Card.

Comparison Table

| Tangerine World Mastercard | Tangerine Money-Back Credit Card | BMO CashBack Mastercard | Simplii Financial Cash Back Visa Card | |

| Annual Fee: | $0 | $0 | $0 | $0 |

| APR Purchases: | 19.95% | 19.95% | 20.99% | 19.99% |

| APR Cash Advances: | 19.95% | 19.95% | 22.99% | 22.99% |

| Maximum Cashback: | 2% | 2% | 3% (with limits) | 4% (with limits) |

| Base Cashback: | 0.5% | 0.5% | 0.5% | 0.5% |

Is the Tangerine World Mastercard for You?

If you want to earn cashback when you spend on your credit card, the Tangerine World Mastercard could be a good choice.

It’s a great way to earn up to 2% cashback on your main purchases, and Mastercard is accepted almost everywhere.

It also includes travel perks, free WiFi access, mobile phone insurance, and more.

The annual income requirement may put it out of reach of some people, but the $0 annual fee makes it a tempting proposition if you want to earn cashback while you spend.

Related: How To Apply For a Credit Card.

FAQs

Got any questions about the Tangerine World Mastercard? Find your answers below:

What credit score is needed for Tangerine Mastercard?

While the credit score required to apply for a Tangerine Mastercard is not specifically stated, you will likely need a good score, which typically means above 660.

What’s the difference between Mastercard and World Mastercard?

World Mastercard offers all the standard benefits of a normal Mastercard but with a few additional perks.

As described in this guide, these perks are primarily travel-related and include access to airport lounges, free WiFi access, and more. However, a World Mastercard will usually have a higher annual income requirement.

Can you use a Tangerine credit card internationally?

Yes, you can use a Tangerine World Mastercard credit card anywhere. Mastercards are used globally, so you can use them anywhere where they are accepted.

What is the minimum credit limit for a World Mastercard?

The minimum Tangerine credit card limit for the World Mastercard is $500. However, this limit may differ for other credit cards, and it depends on the card issuer.