A loan is a sum of money lent to a borrower that will be repaid in the future with interest charges.

There are many reasons you may need a loan, whether it be to buy your first home, purchase your dream car, or start a business.

In this review, we’ll do a deep dive into Fairstone, a financial institution that offers a variety of financial products. We cover Fairstone’s loan requirements, pros and cons, and possible alternatives.

What Loans Does Fairstone Offer?

Fairstone offers a wide range of loans, which include:

- Secured Personal Loans – With this loan, you can access lower payments, lower interest rates, and more funds by leveraging the security of your assets like your home.

- Unsecured Personal Loans – Unsecured loans, if you have good credit, will let you borrow money for unexpected expenses, debt consolidation, and more.

- Home Equity Loans – As a homeowner, you can tap into Home Equity to qualify for favourable, affordable credit and lower interest rates.

- Car and Auto Loans – You can borrow up to $20,000 to purchase a used vehicle from a private seller.

- Online Loans – You can get money online in the comfort of your home in as little as 24 hours.

Fairstone Loan Requirements

The following are the loan requirements to get a secured personal loan:

- Be a Canadian resident

- Be of the age of majority in your province

- Employed, with proof of income

- A homeowner with an established home equity

- Have a bank account under your name

These are the loan requirements to get an unsecured personal loan:

- Be a Canadian citizen or resident

- Be of the age of majority in your province

- Have proof of regular employment

- Have a bank account under your name

To complete your loan, make sure to have the following documents ready:

Personal Identification

Provide a single piece of primary identification:

- Valid Canadian Driver’s License

- Valid Canadian Passport

- Canadian Permanent Resident Card

- Canadian Citizen Card

If the options on top are not available, you can also provide two pieces of secondary identification:

- Canadian Birth Certificate (Government Issued)

- Bank Statement

- A Credit or Debit card with your photo on it

- Military ID Card

- Utility Bill from the past month with your current address and full name

- Provincial Health Card

Employment and Income

To verify your employment and income, provide one of the following:

- Your current payslip that was issued in the last 30 days showing your year-to-date income, EI and CPP deductions, and the name and logo of the firm.

- Latest T4/T4a

- CPP statement dated within the last 12 months.

If you’re self-employed, you need to provide the CRA Notice of Assessments for the past 24 months and one of the following:

- Bank statement that shows the business name

- Business License

- Yellow Page Listing or 411

Housing Information

Provide one of the following to verify your rent:

- Any of the following dated within three months:

- Cancelled cheque

- Rent receipt

- Electronic fund transfer or bank statement

- Handwritten or typed letter showing the rent cost with the landlord’s signature

Provide one of the following to verify your mortgage:

- The latest mortgage statement that contains your name and address, current balance, payment status, and monthly payment.

- Annual mortgage statement dated within the past month.

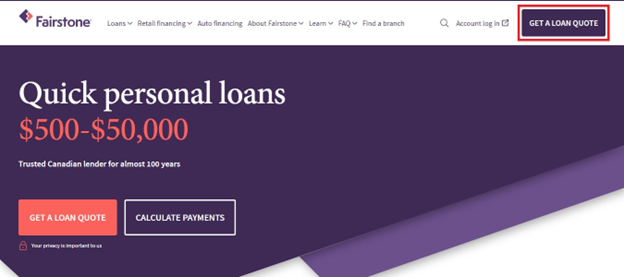

How to Apply for a Fairstone Loan

Do the following steps to apply for a loan from Fairstone:

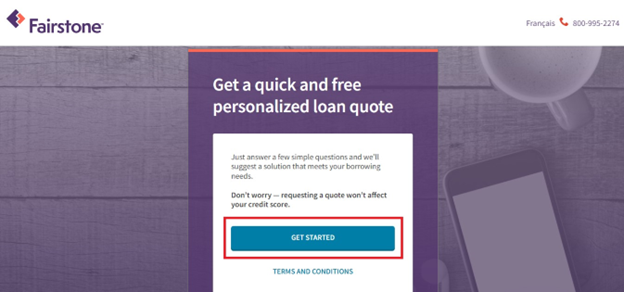

Get a Loan Quote – All you need to do is enter a few details to get a loan quote personalized for you in minutes. There are no obligations once you receive the quote and this will not impact your credit score.

Step 1: Click on “GET A LOAN QUOTE” on the top right-hand side of your screen.

Step 2: Click “GET STARTED.”

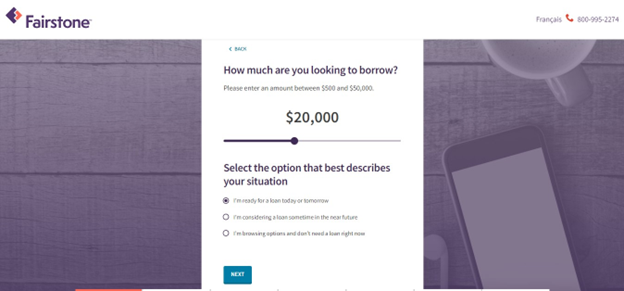

Step 3: Use the slider to show how much you’re looking to borrow, then select from the options below the statement that best describes your situation.

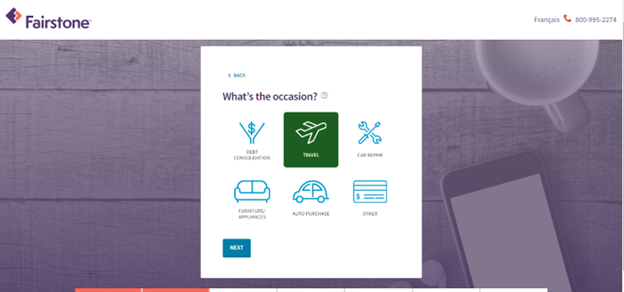

Step 4: Select what the loan will be used for.

Step 5: Enter your full name and date of birth.

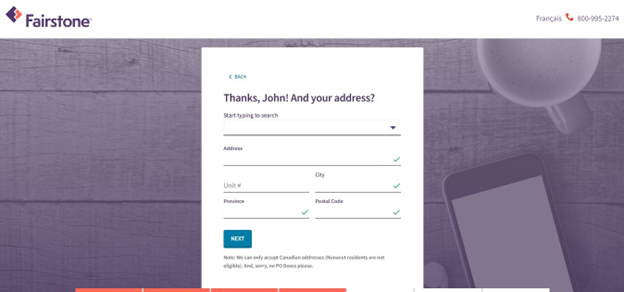

Step 6: Enter your address.

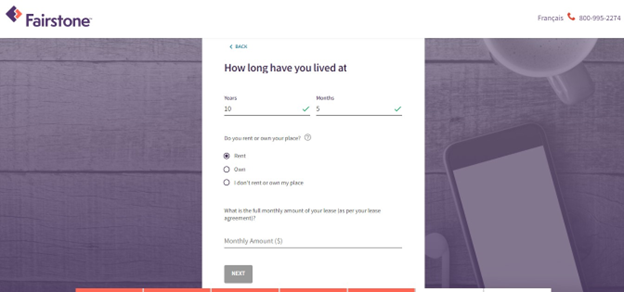

Step 7: State how long you’ve lived at your current address and the full amount of your mortgage if you own the home, or the full monthly amount of your lease if you rent.

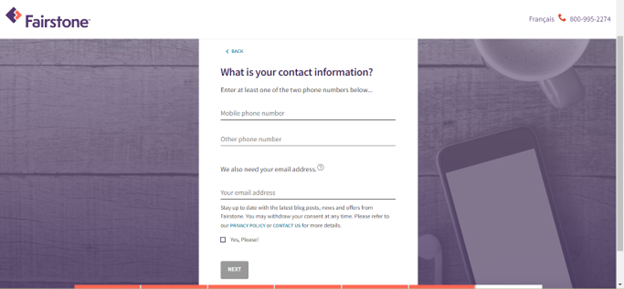

Step 8: Enter your contact information and email address.

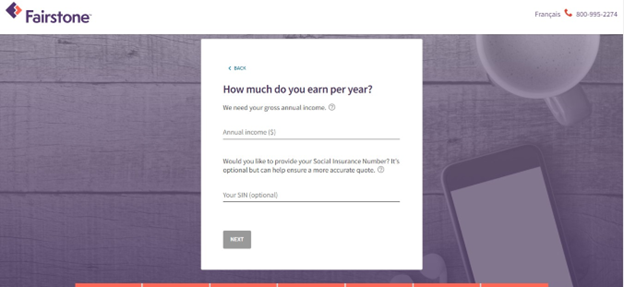

Step 9: Enter your gross annual income.

Step 10: The final page will show all the information you have entered, and will give you a chance to edit any information if there are errors.

If everything is correct, click on “GET YOUR QUOTE” to finish the process.

Connect with a Lending Specialist – You will get connected with a lending specialist to customize the details of your loan.

Finish the Loan Application – Complete the needed documents to finalize your loan application.

Pros and Cons of Fairstone

Here are the Pros of getting a loan with Fairstone:

Loan size flexibility – Fairstone offers loans between $500 to $50,000, which suits the needs of a wide range of borrowers.

Loan term flexibility – Depending on how much you borrow and the repayment schedule set, there are terms of 6 months to 120 months available.

Wide branch network – Fairstone is very accessible, with over 240 branches across the country.

Quick access to funds – You may have access to your loan within one business day if your application is approved.

Established financial institution – Fairstone has been providing loans for many decades, so you are dealing with a legitimate lender.

Here are the Cons of getting a loan with Fairstone:

High-interest rates – Fairstone’s interest rates start at 19.99%. If you have an excellent credit score, you may be able to secure better rates from other traditional and online lenders.

Physical application – You will need to submit the needed documents at a Fairstone branch if you’re applying for a secured personal loan.

Prepayment penalty – A prepayment penalty will apply if you want to pay off your secured loan early in the first 36 months.

Additional charges – Applying for a secured loan with Fairstone comes with additional charges to do a home valuation, title search, and the like. This is because Fairstone needs to ensure that your home is properly valued to decide how much they will lend you.

Fairstone Alternatives

Loans Canada

Loans Canada is a loan comparison platform where you can research and compare lenders before applying. Once you submit your application, you will be connected with lenders that you qualify for.

On the platform, you can apply for personal loans, car loans, debt consolidation, business loans, and home equity loans.

The following are the loan features of Loans Canada:

- Loan Amount – $300 – $50,000

- Interest Rate – 2.99% – 46.96%

- Loan Term – 3 months – 6 months

- Eligibility – Be a Canadian resident or citizen, be the age of majority in your territory, have a consistent income, and have a minimum credit score of 300.

AimFinance

AimFinance is a platform that offers personal loans. You can borrow up to $5,000. However, AimFinance’s services are only available to Canadians based in Ontario.

Besides the loans, AimFinance also provides educational articles on personal finance available to anyone who visits their website.

AimFinance may give a quick lending decision once you submit your application. If you are approved, you may get the money in your bank account within one to two days.

The following are the loan features of AimFinance:

- Loan Amount – $1,000 – $5,000

- Interest Rate – 46%

- Loan Term – 9 months – 24 months

- Eligibility – Be a resident of Ontario, at least 18 years of age, a Canadian citizen, have an active Canadian bank account, a minimum monthly income of $1,200, a fair to good credit score, and proof of steady income.

FatCatLoans

On FatCatLoans, you can get a personal loan of up to $50,000. The platform can help you find a loan by connecting you with its lending partner network. Even those with bad credit may still get approved.

The online application takes a few minutes to complete, and if you get approved, you may get the money within the same day.

You can apply for a line of credit, personal loans, bad credit loans, installment loans, online loans, car loans, no credit check loans, and consolidation loans.

The following are the loan features of CatFatLoans:

- Loan Amount – $300 – $50,000

- Interest Rate – 6.99% – 46.96%

- Loan Term – 3 months – 120 months

- Eligibility – Have a minimum monthly income of $1,000, a minimum credit score of 300, and be 18 years of age.

LoanConnect

LoanConnect is considered the search engine for personal loans in Canada. With their vast network of lenders, you may find a loan offer with competitive rates that best suits your needs.

On LoanConnect, you can apply for personal loans, debt consolidation, car loans, vacation loans, home improvement loans, business loans, and online cash loans.

The following are the loan features of Loan Connect:

- Loan Amount – $500 – $50,000

- Interest Rate – 6.99% – 46.96%

- Loan Term – 3 months – 120 months

- Eligibility – You must have a minimum credit score of 300, and your current debt must total less than 60% of your income.

Is Fairstone Legit?

Yes, Fairstone is a legitimate and established financial institution. The firm has a long history of providing a wide range of financial products and services in Canada.

FAQs

Does Fairstone affect your credit?

Getting a loan quote with Fairstone does not affect your credit. If you go ahead and apply for the loan, a hard credit check is carried out, which can negatively impact your score temporarily.

How do I get rid of my Fairstone loan?

You will need to request for a discharge by contacting your local branch. A lending specialist will collect a discharge fee.

What is the interest rate at Fairstone?

The interest rate for a secured personal loan ranges between 19.99% to 24.49%. While the interest rate for an unsecured personal loan ranges between 26.99% to 39.99%.

How fast do you get money from Fairstone?

If your loan application gets approved, you may receive the money in as little as one business day.

What happens if you don’t pay Fairstone?

If you don’t make your payments, Fairstone may charge you fees, your credit score may be negatively affected, or your collateral may be at risk.

Who owns Fairstone?

Fairstone is a subsidiary fully owned by Fairstone Bank of Canada.

How do I contact Fairstone customer service?

To contact Fairstone customer service, you can head over to their Contact Us page. You can also call them directly by dialling 800-995-2274.

Related: