The Scotia Momentum Visa card is one of the best cash back credit cards for Canadian residents.

It offers up to 2% cash back on eligible purchases and recurring payments for a low annual fee of $39.

This review article covers the Scotia Momentum Visa card’s benefits, downsides and application process to help you decide whether it’s the best credit card for your needs.

Scotia Momentum Visa Card – Summary

Scotia Momentum Visa Card

Rewards: Earn up to 2% cash back on groceries, drugstores, gas stations, and recurring bill payments, and 1% cash back on everything else.

Welcome offer: Get a 0% introductory balance transfer interest rate for the first 6 months.

Interest rates: 19.99% for purchases, 22.99% for cash advances.

Annual fee: $39

Recommended credit score:

Good to Very Good

On Scotiabank’s website

Benefits of the Scotia Momentum Visa Card

This credit card offers many benefits for its users. The most significant ones are listed down below.

Up To 2% Cash Back

Earn 2% cash back on every dollar you spend on your eligible recurring bill payments and grocery store, gas station and pharmacy purchases. You’ll enjoy this cash back rate for the first $25,000 you receive cash back for. After exceeding that threshold, you’ll earn 1% cash back on your next eligible purchases.

Note: Transactions such as balance transfers, cash advances, and refunds don’t qualify for cash back.

Save On Car Rentals

Save up to 25% of the car rental base rates of participating AVIS and Budget locations in Canada and the U.S. when you pay for reservations using your Scotiabank Momentum Visa card.

Purchase Security & Extended Warranty For Your Purchases

For most items you fully pay for using this Scotiabank Visa card, you’ll double the original manufacturer’s warranty coverage of your product for up to one year.

Plus, for the first 90 days from their purchase date, your products will be insured against loss, damages, and theft.

For items with a manufacturer’s warranty of five years or longer, you must register for this service within the first year of your product purchase.

Note: The maximum per-claim occurrence is $10,000; you may only claim $60,000 throughout the credit card’s lifetime.

Other Benefits

Other Scotiabank Momentum Visa benefits include:

- Faster checkouts thanks to Scotiabank’s partnership with software like Google Pay and Apple Pay that allows you to pay using your smartphone.

- Optional insurance coverage that provides you and your family members financial protection during unexpected life events.

- Low-income requirements make it easy for anyone, including part-timers, and newcomers, to apply for this credit card.

Downsides of the Scotia Momentum Visa Card

While the Scotia Momentum Visa Card is one of my top-recommended low-fee credit cards, it still has some downsides you must know.

Limited Cash Back-Eligible Purchase Categories

The Scotia Momentum Visa Card only offers cash back for purchases at eligible gas stations, grocery stores, drug stores, and recurring bill payments.

Other common spending categories, such as entertainment, dining, and streaming services, aren’t eligible for cash back.

Spending Cap On The 2% Cash Back Rate

Only the first $25,000 you spend on eligible purchases will get a 2% cash back rate. The ones that follow will only give you a 1% cash back.

Annual Fee of $39

Although this Scotiabank credit card has a fairly affordable annual fee, paying $39 yearly is still a drawback compared to getting no-fee cash back credit cards.

How to Apply for the Scotia Momentum Visa Card

There are several ways to apply for the Scotia Momentum Visa Card. You may do this process through online banking, by calling Scotiabank’s customer support or by visiting one of the bank’s local branches.

Any Canadian resident that’s at least the age of provincial majority and has not declared bankruptcy for the past 7 years is eligible to apply for this credit card, as long as they have a minimum annual income of $12,000.

Note: Granting Scotiabank access to your credit bureau report is mandatory when you apply for the Scotia Momentum Visa card.

Scotia Momentum Visa Card Alternatives

If you’re interested in knowing other credit cards that can match or exceed the benefits of a Scotia Momentum Visa Card, check the cards listed below.

Scotia Momentum Mastercard Credit Card

Scotia Momentum Mastercard

Rewards: Earn up to 1% cash back on gas, grocery, drug stores, and recurring payments; 0.5% on everything else.

Welcome offer: Get an extra 15% cash back on up to $1,000 in spending in the first 2 months ($150 value).

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Annual fee: $0

Tangerine Money-Back Credit Card

Tangerine Money-Back Credit Card

Rewards: Earn 2% unlimited cash back in up to 3 categories of your choice plus 0.50% on all other purchases.

Welcome offer: Get an additional 10% cash back after spending $1,000 in the first 2 months ($100 value).

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Annual fee: $0

Recommended credit score:

Fair to Excellent

On Tangerine’s website

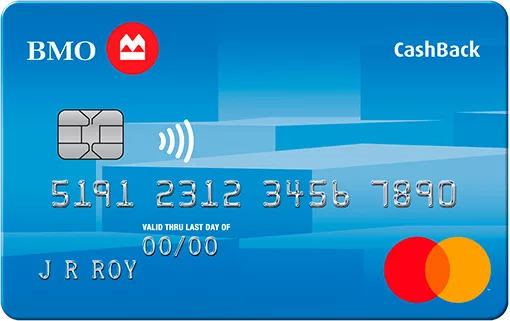

BMO Cash Back Mastercard

BMO CashBack Mastercard

Rewards: Earn up to 3% cash back on groceries and 1% in other categories.

Welcome offer: Get up to 5% cash back in the first 3 months and a 0.99% introductory balance transfer rate for 9 months.

Interest rates: 20.99% for purchases, 22.99% for cash advances.

Annual fee: $0

Recommended credit score:

Good to Excellent

On BMO’s website

Scotia Momentum Visa Card vs Alternatives Summary

| Credit Cards | Annual Fee | APR Purchases | APR Cash Advances | Cash Back For Every $1 |

| Scotia Momentum Visa Card | $39 | 19.99% | 22.99% | Up to 2% |

| Scotia Momentum Mastercard Credit Card | $120 | 20.99% | 22.99% | Up to 1% |

| BMO Cash Back Mastercard | $0 | 20.99% | 22.99% (21.99% for Quebec residents) | Up to 3% |

| Scotia Momentum No-Fee Visa Card | $0 | 19.99% | 22.99% | Up to 1% |

| Tangerine Money-Back Credit Card | $0 | 19.95% | 19.95% | Up to 2% |

Scotia Momentum Visa Card: Conclusion

The Scotia Momentum Visa Card is a great credit card option if you don’t want to spend over $100 on your card’s annual fee. It has a decent cash back rate of up to 2% and several exclusive benefits that make day-to-day purchases cheaper and more secure.

Related: