Are you in search of a credit card that offers incredible rewards and benefits?

Look no further than the HSBC+ Rewards Mastercard. This sought-after rewards credit card in Canada has become a favourite among cardholders. It provides a wide range of advantages and perks.

In this comprehensive review, we will explore the features, advantages, and drawbacks of the HSBC +Rewards Mastercard, including its HSBC Travel Rewards program and HSBC Mastercard Rewards login process.

HSBC +Rewards Mastercard – Summary

HSBC +Rewards Mastercard

Rewards: Earn 2 points for every $1 spent on dining and entertainment, and 1 point for every $1 spent on everything else.

Welcome offer: Earn up to 35,000 points ($175 in travel rewards), plus get the first year annual fee rebated.

Interest rates: 11.9% for purchases, balance transfers, and cash advances.

Annual fee: $25

Recommended credit score:

Good to Excellent

On HSBC’s website

Benefits of the HSBC +Rewards Mastercard

The HSBC +Rewards Mastercard comes packed with several enticing benefits that cater to the needs of Canadian consumers. Let’s explore the key advantages offered by this credit card:

- Reward Points Accumulation: Earn 2 points for every dollar spent on eligible entertainment and dining purchases and 1 point for all other purchases.

- Price Protection Service: If you see a qualified item purchased in Canada promoted at a lower price (same make, model, and features) within 60 days, you will be refunded the difference up to $500 per item (up to $1,000 per year Dollar).

- Purchase Protection: covers up to 90 days from the purchase date in cases of theft or damage.

- Extended Warranty Protection: the manufacturer’s original Canadian warranty is doubled for up to an additional year for eligible purchases, providing additional protection.

- Enjoy low-interest rates for purchases and cash advances at 11.9%.

- Contactless Payment Technology: Experience the convenience and security of contactless payments via Apple Pay and Tap & Go and Zero Liability protection for unauthorized card usage.

Downsides of the HSBC +Rewards Mastercard

While the HSBC +Rewards Mastercard boasts numerous benefits, it’s important to consider the potential drawbacks before making a decision:

- Annual Fee: This card comes with an annual fee of $25 for primary cardholders and $10 for supplementary cardholders.

- No built-in Travel and Medical Insurance: There’s no default travel and medical insurance. But, optional travel and medical insurance coverage can be added with a yearly premium of $69.

- Foreign Currency Conversion Fee: Charges a standard 2.5% fee on purchases made in foreign currencies.

How to Apply for the HSBC +Rewards Mastercard

Applying for the HSBC +Rewards Mastercard is a straightforward process. Follow these steps to initiate your application:

- Before starting, keep one of the following I.D handy (make sure the I.D you are using is still valid):

- Passport

- Driver’s Licence or

- Provincial government Issued I.D.

- Visit the official HSBC website or branch to access the application form.

- Review the terms and conditions carefully before submitting your application.

- Await the bank’s decision, which typically includes a credit check.

In order to qualify, you must:

- Be a Canadian resident

- Has reached the age of majority in the province where you live

HSBC +Rewards Mastercard Alternatives

In addition to the HSBC +Rewards Mastercard, several alternatives are available in the Canadian credit card market. Here are some notable options:

RBC ION+ Visa Credit Card

The RBC ION+ Visa, a low annual fee card, is one of two new cards from a trusted name in Canadian finance. For a small fee (billed monthly instead of annually), cardholders can earn money on some lucrative Avion points in several categories.

RBC ION+ Visa

Annual fee: $48

Welcome offer: Get 7,000 bonus Avion points following approval.

Rewards: Earn 3x Avion points per $1 spent on groceries, rides, gas, streaming, subscriptions, digital gaming, and EV charging; 1 Avion point for every $1 spent on all other purchases.

Interest rates: 19.99% on purchases and 22.99% on cash advances.

Minimum income requirement: None

- Earn 3 Avion points for every dollar you spend on groceries, rideshare, daily public transit, gas, streaming, subscriptions, and digital gaming.

- Earn 1 Avion point for every dollar you spend on all other qualifying purchases.

- Save 3¢/L on fuel purchased at Petro-Canada when you link your credit card to your Petro-Canada Card.

- Redeem your points for air travel, gift cards, merchandise, statement credits, dining, etc. The minimum redemption is only $10.

- Get a 3-month complimentary DashPass subscription, valued at almost $30.

- Offers mobile device insurance and optional travel insurance coverage.

- Includes Purchase Security and Extended Warranty Insurance.

Competitive purchase APR at 19.99%

Attractive point redemption options

No minimum income threshold

Limited insurance benefits

The conversion rate for points is not as enticing

The RBC ION+ Visa is a step up from the RBC ION Visa, with double the points on specific purchases. It is an excellent choice for students or newcomers looking to get approved for their first credit card in Canada.

Neo Card

Neo Financial is a Canadian fintech company that offers a credit card with three levels of cashback rewards and a savings account with a higher than average interest rate. Neo is different from other credit card companies in that it is 100% digital.

Neo Financial Mastercard

Rewards: Earn up to 15% cash back at Neo partners and never fall below 0.5% average cash back.

Welcome offer: Get an extra 15% cash back on your first purchases at many Neo partners.

Interest rates: 19.99% to 26.99% for purchases, 22.99% to 28.99% for cash advances.

Annual fee: $0

Recommended credit score:

Fair to Excellent

On Neo’s website

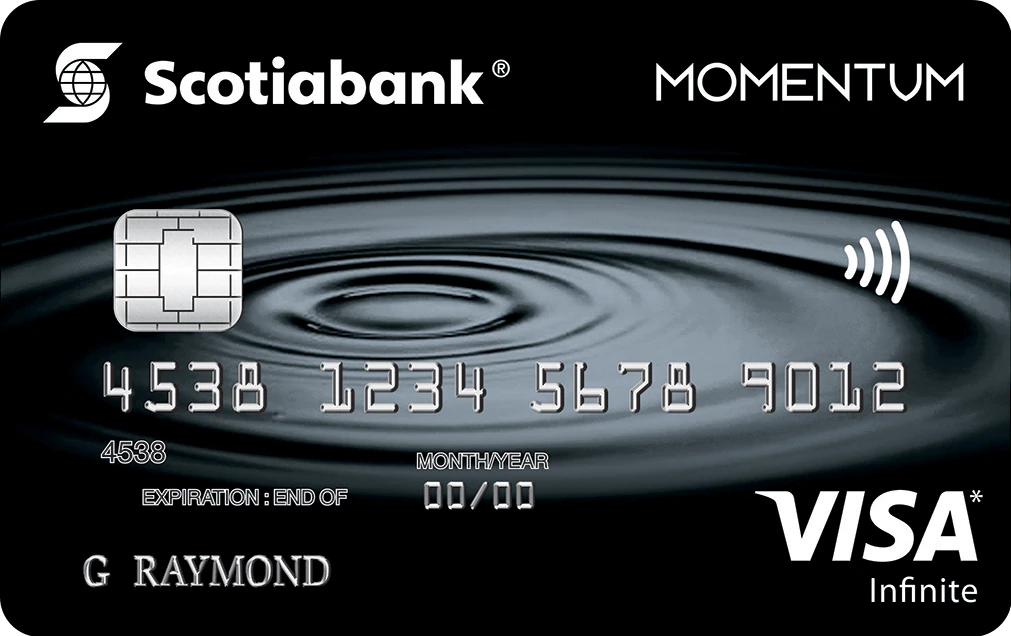

Scotia Momentum Visa Infinite Card

The Scotia Momentum Visa Infinite Card is a credit card that offers cash-back rewards on every purchase. It also provides access to exclusive experiences related to hotels, dining, and wine.

Scotia Momentum Visa Infinite Card

Rewards: Earn up to 4% cash back on everyday purchases.

Welcome offer: Earn 10% cash back on all purchases in the first 3 months (up to $2,000), and get the annual fee waived for the first year.

Interest rates: 20.99% for purchases, 22.99% for cash advances.

Annual fee: $120

Recommended credit score:

Very Good to Excellent

On Scotiabank’s website

| Credit Card | Annual Fee | APR Purchases | APR Cash Advances | Rewards |

| HSBC +Rewards Mastercard | $25 | 11.99% | 11.99% | 2X points for every $1 spent on eligible entertainment and dining purchases 1X point on everything else |

| Scotia Momentum Visa Infinite Card | $120 | 20.99% | 22.99% | 4% for every dollar spent on subscriptions, recurring payments, and grocery store purchases. |

| Neo Mastercard | $0 | 19.99%-26.99% | 22.99%-28.99% | 5% average cash back at 10,000 affiliated merchants across Canada |

| RBC Ion+ Visa Card | $48 | 20.99% | 22.99% | 3X Avion points per $1 spent on gas, groceries and entertainment Earn 1X Avion points on everything else |

Is the HSBC +Rewards Mastercard Worth It?

If you’re looking for an inexpensive card with low-interest rates and fees, this is the card you should consider. The HSBC +Rewards™ Mastercard® offers customers solid, fundamental coverage with limited benefits and no minimum income requirements and allows you to earn points on every purchase.

But if you prefer a no-fee credit card with built-in travel and medical insurance coverage, this card probably isn’t for you.

There are many cards that offer more benefits and reward you with more points per dollar spent.

But these cards come with higher fees and less favourable interest rates. Thus, you should consider all these factors before choosing your card of choice.

FAQs

Can I apply for the HSBC +Rewards Mastercard online?

Yes, you can visit the official HSBC website or a branch nearest you to access the online application form. Make sure you have a valid ID ready before starting the application process.

Are there any welcome bonuses or offers for new cardholders?

While this review focuses on the regular benefits and rewards, HSBC occasionally offers welcome bonuses. Currently, they offer a first-year annual fee waiver. Also, you can earn 35,000 points after spending a total of $2,000 within 180 days of opening your account.

How can I redeem the reward points earned with the HSBC +Rewards Mastercard?

You can redeem your reward points through the HSBC +Rewards Program. Visit the HSBC rewards website or contact their customer service hotline to explore other redemption options.

Related: