Canada is known for its stable economy, and it’s no surprise that the country has some of the most reliable banks in the world. But choosing the right one can be challenging.

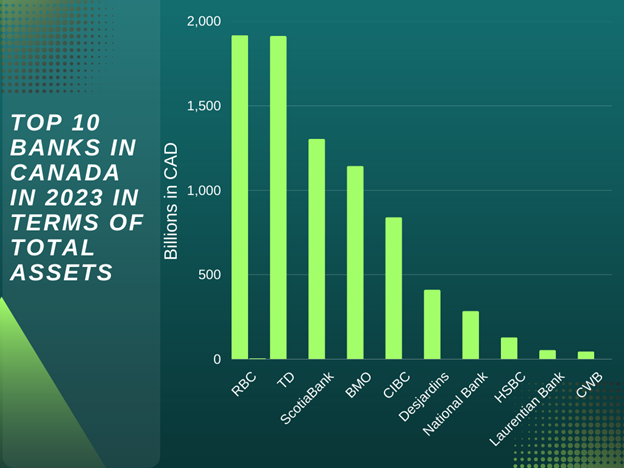

We’ve put together a list of the largest banks in Canada by assets to help you make an informed choice.

This list includes the top 5 banks from among the top 10 banks in Canada. But that’s not all; we’ve also included information on international banks in Canada.

Main Highlights

- The big 5 banks in Canada (RBC, TD, Scotiabank, BMO, and CIBC) dominate the banking sector and account for most of the market share.

- Each bank has its own strengths and weaknesses, and choosing the right bank depends on your individual needs and preferences.

- RBC is the largest bank in Canada by assets, revenue, and market capitalization followed by TD and Scotiabank.

- Desjardins Group is a popular option for those looking for a credit union or cooperative.

- HSBC and CIBC are a popular banks in Canada for international students with their newcomer banking offers.

List of the Top 10 banks in Canada

1. Royal Bank of Canada (RBC)

RBC is the largest bank in Canada by assets, revenue, and market capitalization, with CAD 1.91 trillion as of 2022. It employs more than 91,000 individuals.

RBC has a wide variety of banking products and services for both individuals and businesses. These include chequing and savings accounts, credit cards, mortgages, loans, investments, and insurance.

2. Toronto-Dominion Bank (TD)

A very close second is TD Bank, with CAD 1.9 trillion in assets as of January 31, 2023, and over 95,000 employees.

TD Bank offers personal and business banking products and services. These include chequing and savings accounts, credit cards, mortgages, loans, investments, and insurance.

TD Bank also offers mobile and online banking services, as well as a rewards program that allows customers to earn points on their purchases.

Related: How To Close a TD Bank Account

3. Bank of Nova Scotia (Scotiabank)

Scotiabank, or the Bank of Nova Scotia, is the third-largest bank in Canada, with CAD 1.3 trillion in assets and over 90,000 employees as of January 31, 2023.

Scotiabank has banking products and services for both individuals and businesses. These include chequing and savings accounts, credit cards, mortgages, loans, investments, and insurance.

Scotiabank also offers mobile and online banking services, as well as a rewards program that allows customers to earn points on their purchases.

4. Bank of Montreal (BMO)

BMO, founded in 1817, is the fourth-largest bank in Canada, with CAD 1.14 trillion in assets and over 46,000 employees as of December 2022.

BMO has banking products and services for both individuals and businesses. These include checking and savings accounts, credit cards, mortgages, loans, investments, and insurance.

If you want to close your existing BMO account, learn how here.

5. Canadian Imperial Bank of Commerce (CIBC)

CIBC is the fifth-largest bank in Canada, with CAD 837.7 billion in assets and over 45,000 employees as of October 31, 2021.

CIBC has banking products and services for both individuals and businesses. These include checking and savings accounts, credit cards, mortgages, loans, investments, and insurance.

It’s popular with students because its student account has no monthly fee and gives unlimited free monthly debit card transactions.

6. Desjardins Group

Desjardins is the largest group of credit unions in North America. It is made up of a group of cooperative financial institutions. It had CAD 407.1 billion in assets and over 58,774 employees as of December 31, 2022.

Specific products and services offered by Desjardins Group include chequing and savings accounts, credit cards, mortgages, personal loans, and lines of credit.

7. National Bank

National Bank is one of the largest banks in Quebec and the sixth-largest bank in Canada, with CAD 281 billion in assets and over 25,000 employees.

NBC offers personal and business banking products and services, including chequing and savings accounts, credit cards, mortgages, loans, investments, and insurance.

8. Laurentian Bank of Canada

The Laurentian Bank of Canada was started in 1846, making it one of the oldest banks in the country. Compared to the other banks on this list, this one is smaller.

It has about 2,800 employees and 145 branches across Canada, with total assets of CAD 50.4 billion as of January 31, 2023.

LBC offers specialized banking services for healthcare professionals. These include tailor-made financial solutions like loans for medical equipment and special mortgages for people who work in the medical field.

9. Canada Western Bank

Canada Western Bank is a regional bank that serves Western Canada. As of December 2022, it had over 2,600 employees and 42 branches in Manitoba, Saskatchewan, Alberta, British Columbia, and the Northwest Territories. Its total assets were worth CAD 41.71 billion as of January 31, 2023.

CWB has a deep understanding of the needs of Western Canadians. As such, it offers customized mortgages for people who live in rural areas and specialized ways to get money for businesses in agriculture and energy.

10. HSBC Bank

HSBC has been acquired by RBC.

HSBC Bank is one of the top international banks in Canada. It has about 4,200 employees and CAD 125 billion in assets as of June 2022. It is the largest foreign bank in Canada.

The bank offers a wide range of financial services. Among these are personal and business banking, wealth management, and insurance.

It is also a popular choice for those who need to transfer money overseas, as they offer competitive foreign exchange rates and low fees for international transfers.

How to Choose the Best Bank For You

Choosing the right bank can be hard, especially when there are so many to choose from. Here are some factors to consider when choosing a bank:

- Fees: Look for a bank that has low fees or no fees at all for the products you need. Some banks offer fee waivers for certain account types or if you maintain a certain balance.

- Convenience: Consider the location of the bank branches and ATMs. If you need to visit a branch frequently, it’s important to choose a bank that has convenient locations.

- Products and Services: Choose a bank that offers the financial products and services that you need. This may include personal or business accounts, credit cards, loans, mortgages, or investment options.

- Customer Service: Look for a bank that provides excellent customer service. You want to choose a bank that is responsive to your needs and concerns.

- Reputation: Research the bank’s reputation and history. Look for reviews online or ask friends and family for recommendations.

EQ Bank Savings Plus Account

Up to 4.00%* non-promotional interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees

Conclusion

The Canadian banking industry is dominated by the big 5 banks, but there are other options available for those seeking specialized services. When choosing a bank, it’s important to think about your financial habits and needs, as well as fees, interest rates, and how easy it is to use.

Our comprehensive guide to the list of banks in Canada has provided you with information on the top banks in Canada, including the largest banks in Canada by assets, the top 5 banks in Canada, the top international banks in Canada, the top 10 banks in Canada, and banks in Canada for international students.

So, if you’re in the market for a new bank, don’t be afraid to shop around and compare your options. Consider your financial goals, your spending and saving habits, and what kind of services and features you need from a bank.

With the stability of the Canadian banking system and a wide range of services, Canadians can trust in the security of their assets and feel confident in their financial decisions.

FAQs

Who is the number 1 bank in Canada?

The Royal Bank of Canada (RBC) is currently the largest bank in Canada by assets, revenue, and market capitalization. It is also one of the largest banks in the world, with operations in over 40 countries.

What are the top 5 banks in Canada by ranking?

The “Big Five” banks in Canada are Royal Bank of Canada (RBC), Toronto-Dominion Bank (TD), Bank of Nova Scotia (Scotiabank), Bank of Montreal (BMO), and Canadian Imperial Bank of Commerce (CIBC), in order of total assets.

Is HSBC leaving Canada?

HSBC has agreed to sell its banking operations in Canada to the Royal Bank of Canada (RBC). The deal is worth CAD $13.5 billion (US$10.1 billion) and is expected to be completed in late 2023, subject to regulatory and governmental approvals.

Which bank is best for foreigners in Canada?

Many Canadian banks have services for newcomers to the country, like no monthly fees, credit-building programs, and help with learning the language. Some popular options include RBC, TD, Scotiabank, and CIBC. It’s important to compare the different options and requirements to find the best fit for your individual needs and circumstances.

Which international bank is best in Canada?

HSBC, Citibank, and JPMorgan Chase are just some of the international banks that do business in Canada. The best international bank for you will depend on your specific banking needs and preferences, such as language support, account fees, and available services. It’s important to do your own research and compare the different options before making a decision.

Related: