Are you using a Canadian bank account to receive or send international or domestic wire transfers? Having trouble finding your Canadian routing number? If so, we’ve got you.

There are quite a few chances that your employer might have asked you what your routing number is. Moreover, you may have looked at routing numbers at the bottom of your cheque.

The primary idea of a routing number is to link a unique number to each Canadian bank.

This helps to make transactions faster and more efficient.

Routing numbers are becoming increasingly popular among Canadians since electronic banking has become common for daily transactions.

This post will discuss everything about routing numbers and help you find your routing number in Canada.

What Is a Routing Number?

It’s a banking code with 8-9 binary or numerical digits. It refers to the branch location and financial institution linked with your account.

Your bank routing number is a combination of your financial institution and transit numbers.

The transit number is the location of your branch and refers to where your bank is based at.

The financial institution number is used to identify the bank or the financial institution.

There are two primary components of a routing number:

- A transit or five-digit branch number

- A three-digit institution number.

A bank routing number consists of five-digit branch and three-digit institution numbers.

To find your routing number, you need to initially search for your transit number and amalgamate it with the institution number.

What Is the Difference Between a Routing Number, Transit Number, and Account Number?

There are several differences between your routing, transit, and account numbers. Let’s look at them in detail.

- Routing Number – If you live in Canada, the banking routing number refers to the combination of your financial institution and transit numbers. It is used to identify banking institutions. You can find it at the bottom of a cheque.

- Transit Number – The transit number refers to the location of your bank branch. You can find it by performing a Google search about your bank branch or looking at your cheque’s bottom.

- Account Number – Your account number is a seven- to twelve-digit number connected to your bank account. It directs the electronic fund transfer system to deposit or withdraw money from your account. When you make payments, you will be asked for this number.

Routing and accounting numbers are used to determine the right bank account.

For instance, if the insurance company wants to deposit money or withdraw funds, it will need your routing and accounting numbers.

If you want to know more about Canadian bank institution numbers, just click here.

What Is a Routing Number Used For?

If you are applying for getting life insurance or making a transaction, you may need a routing number.

The insurance company will ask about your account and routing numbers. This is all part of the digital receipt.

Once you agree to the insurance offer, you will be asked to fill out a pre-authorized debit or pre-authorized cheque form.

PACs and PADs use routing numbers to find the correct account to withdraw funds.

How Can You Find Your Routing Number on a Cheque?

If you are someone who has never heard of a” routing number,” look for it on your banking cheques.

They have your account number and routing number printed at the bottom left. These numbers are generally written in different fonts.

Both the routing number and cheque number are separated using symbols. This is done to make it easy for you to differentiate between them.

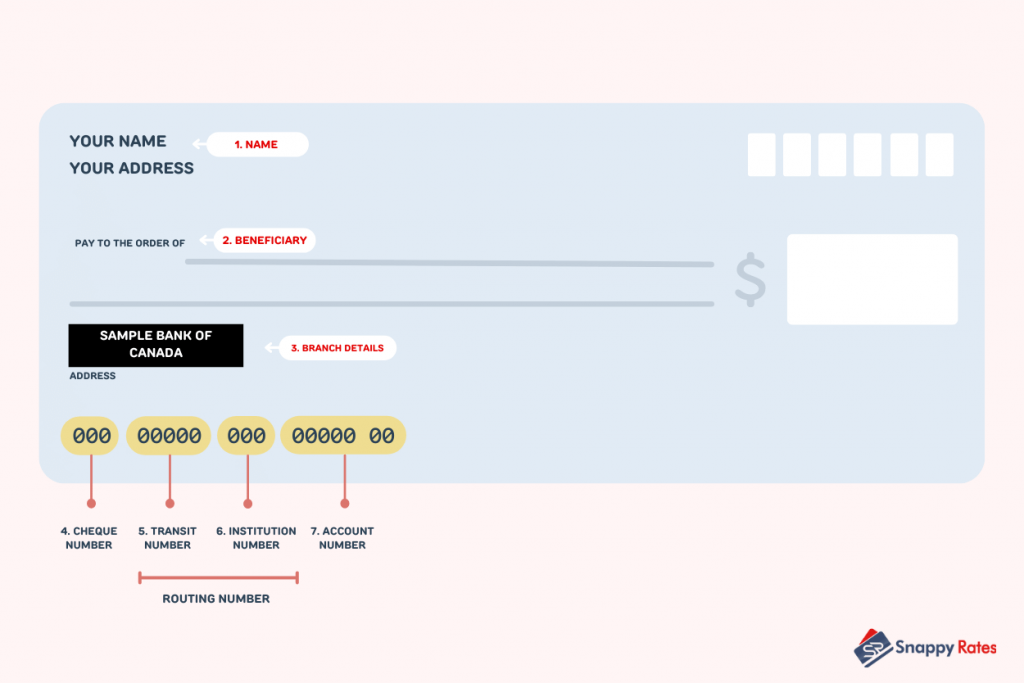

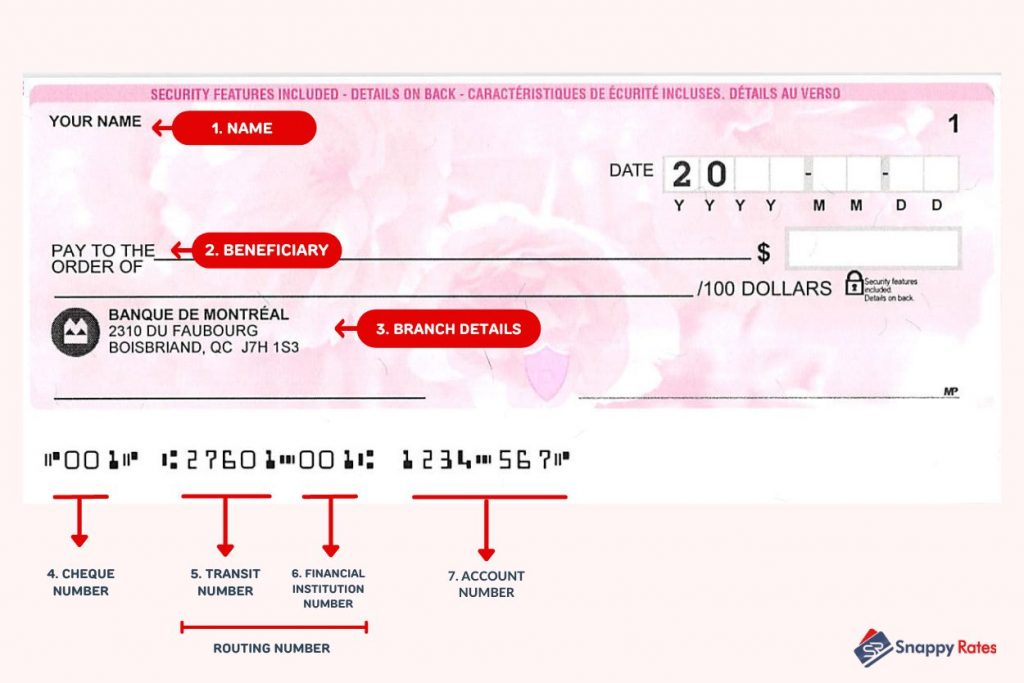

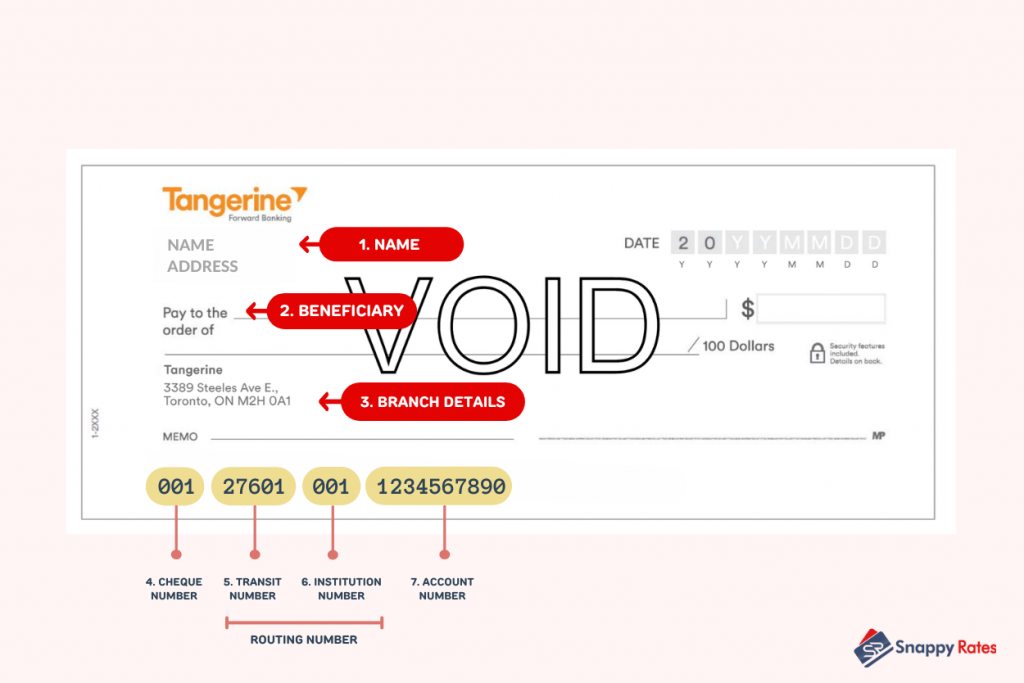

When you look at the sample cheque above, the numbers from left to right are the following:

- Cheque number

- Transit number

- Financial institution (bank) number

- Designation and account number

If you are still unsure about your banking numbers, inquiring about your bank’s institution number could be helpful.

The institution number helps locate where the account number starts and the transit number ends.

You can find the institution number from the group of numbers close to the bank transit number compared to other numbers in the check.

How Can You Search for a Routing Number Without a Cheque?

If you can’t acquire or don’t have a cheque, you could search for the routing number on your online account.

You may also find the routing number by looking at direct deposit forms or void cheques.

Moreover, some banks also have routing numbers in the accounts’ details section.

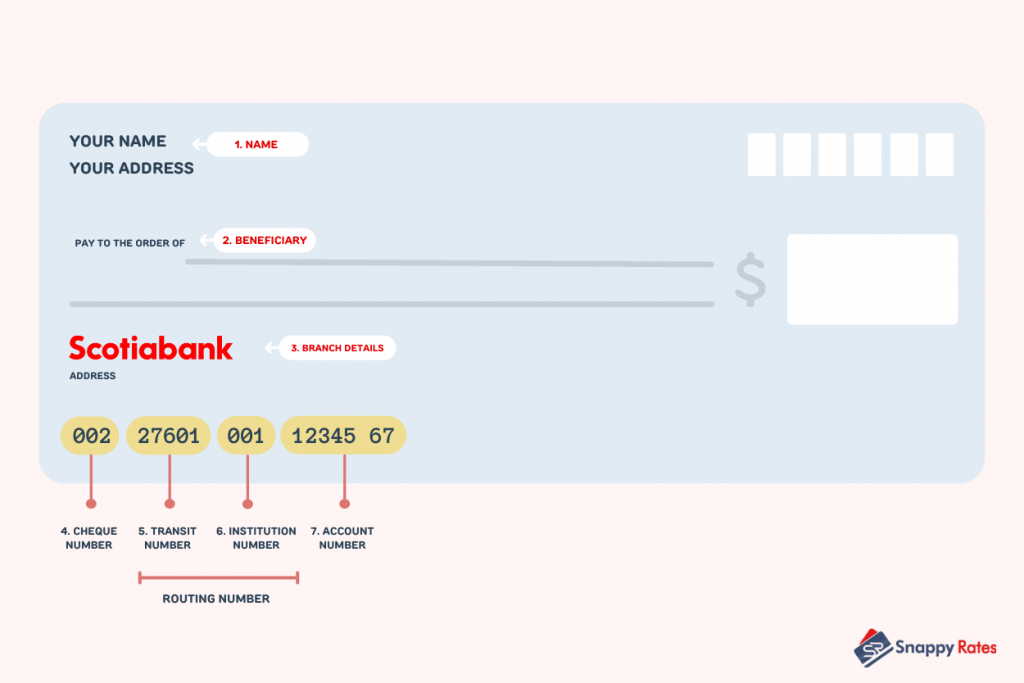

How Can You Search For Scotiabank Routing Number?

You can search Scotiabank routing number by logging in to your online banking account at Scotiabank.

It’ll be listed in your account details or on a void cheque.

But if that’s a bit confusing, we’ve got some handy steps you can follow to find your Scotiabank routing number:

- Sign in to your Scotiabank online account.

- Select a chequing account from your accounts section.

- Click the shown account number to see your branch, account, and institution numbers.

You can look at the void cheque by going to your accounting section and choosing “Direct Deposits and Payments.”

The section will display a void cheque, which you can print by clicking the “Print” option.

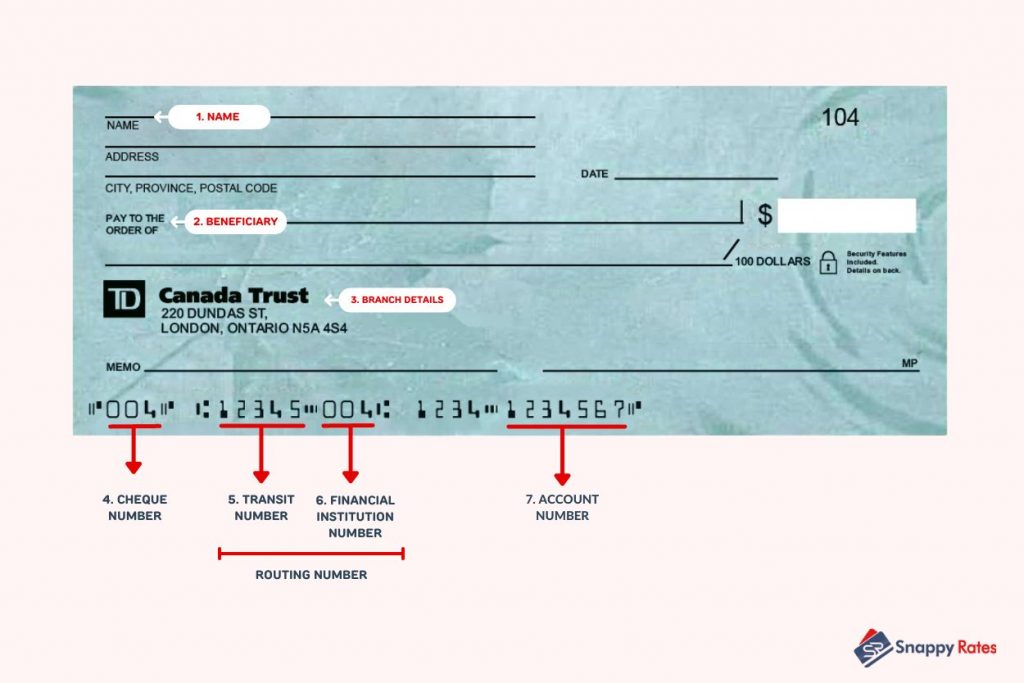

How Can You Search For TD Routing Number?

You can look for your TD routing number in your EasyWeb account. Here’s how to find your TD routing number:

- Log on to your Easy Web account.

- Choose “Accounts” from the menu.

- Choose the account you need the routing number for.

- Select the “Direct Deposit Form” option. This will appear as a PDF already filled with your institution and branch numbers.

How Can You Search For BMO Routing Number?

To find your BMO routing number, sign in to your BMO online account and follow these steps:

- Choose the “My Accounts” option.

- Select the account for which you need the routing number.

- Find your institution number and branch number.

You can also choose the “void cheque” link. The link can be used to download a PDF that contains your account information, including a routing number.

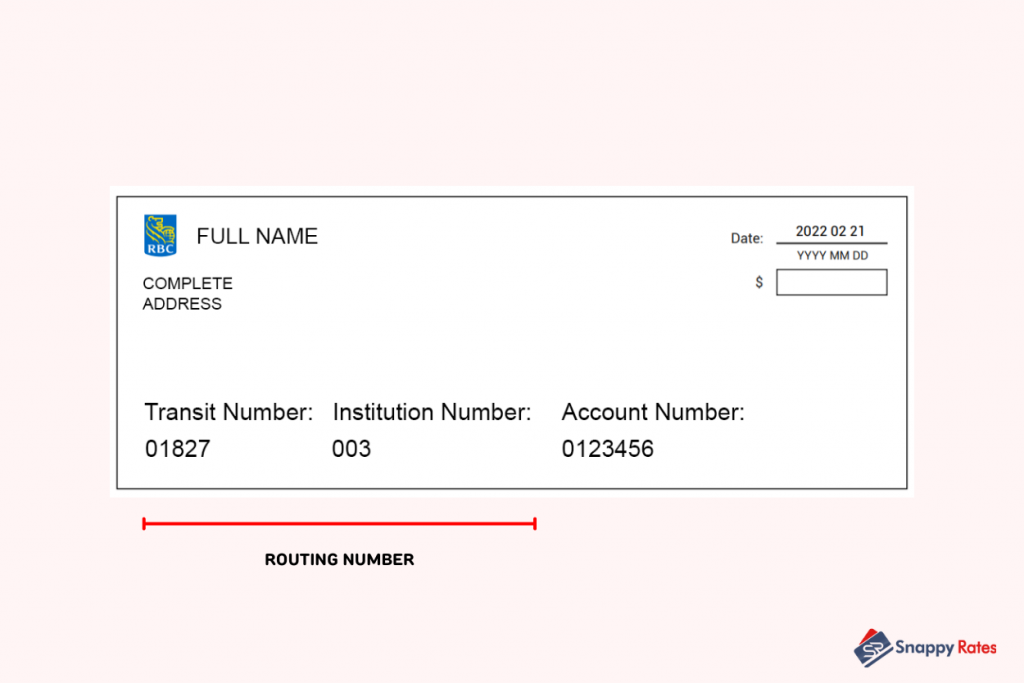

How Can You Search For RBC Routing Number?

You can search for an RBC routing number by signing in to your RBC online banking account, checking account details, or looking at an online void cheque.

To get your account details, you can follow these steps:

- Sign in to your RBC online account.

- Choose a chequing account.

- Select the option to print the direct deposit form of payroll on the right side of the page.

- Choose the print option, which will then display the prefilled form. The form will already have the relevant details you are looking for.

The institution number and transit number of RBC are found after the initial three numbers.

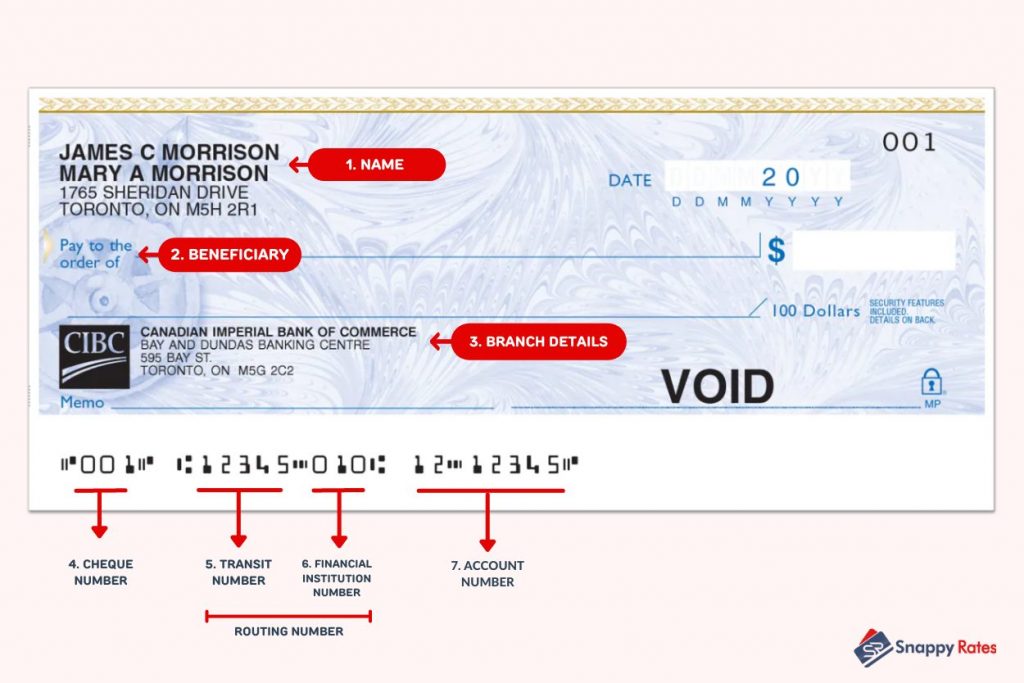

How Can You Search For CIBC Routing Number?

Here are the steps you need to follow to view your account details:

- Sign in to your CIBC online account.

- Look for the number linked to your account. The initial five-digit number shown is known as a transit number. The last seven-digit number is called a bank account number.

- Look at the top of the CIBC account e-statement. You’ll find the routing number there.

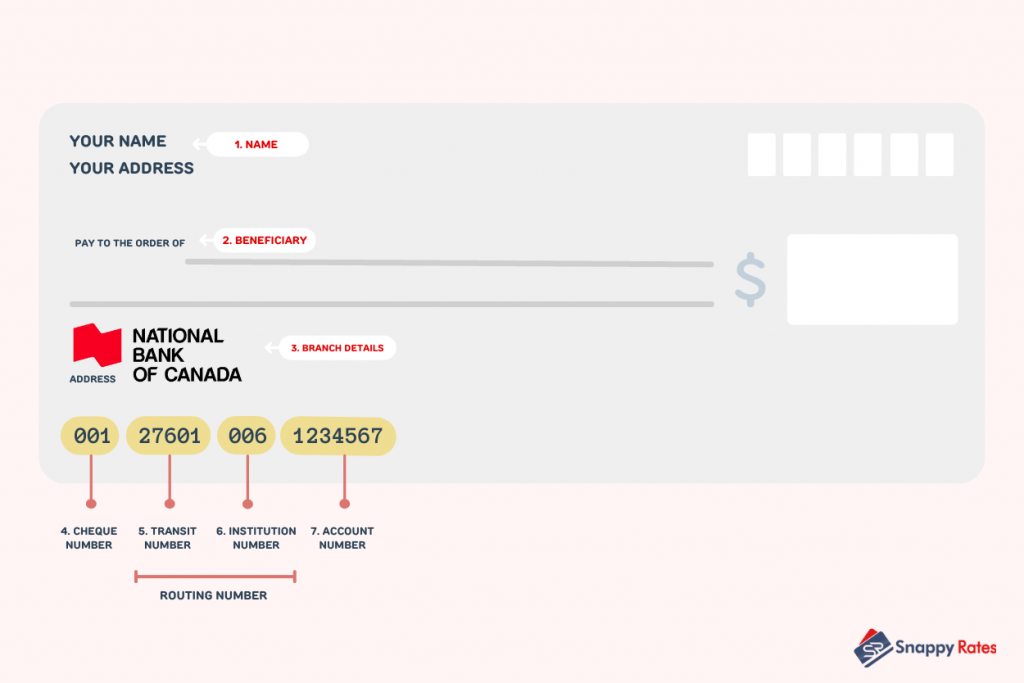

How Can You Search For National Bank Routing Number?

Finding the National Bank routing number is quite simple. You can discover it in the following ways:

- If you have a cheque, the account number is shown at the very bottom. 006 is the National Bank institution number, which follows your five-digit transit and seven-digit account numbers.

- You can look for your account number on your bank statement.

- You can view your National Bank routing number through online banking. The first step is to visit the online banking website. Choose “Overview” and select “Your Account.”

How Can You Search For Tangerine Routing Number?

Here’s how you can access your Tangerine routing number:

- Sign in to your Tangerine online account.

- Choose the relevant bank account.

- Look at the accounts and download the PDF of the void cheque.

- Find the transit/branch and institute numbers at the bottom of the cheque.

However, remember that Tangerine’s clients always have the following routing number: 00152.

The Takeaway

Whether it is your paycheque, vendor, or other automatic payments, routing numbers have become integral to your daily life.

The easiest way to look for a routing number is at the bottom of your cheque.

Other routing numbers, such as Tangerine Routing Number, National Bank Routing Number, etc., can be found by signing into their online banking portals.

FAQs

How do you find your bank account number?

You can find it at the bottom of your cheque alongside your institution and branch numbers.

How many digits are in the Scotiabank account number?

The Scotiabank account number is seven digits long and is generally preceded by your account’s transit number. The Scotiabank account, branch/transit, and institution numbers can be found on your cheque.

What is my bank institution number?

The institution number tells you which bank or financial institution your account belongs to. You can find the Institution numbers of all the major banks in Canada here.

How do I find my bank transit number?

Your bank transit number is linked with the bank branch where you initially opened your bank account. You can find all the bank transit numbers in Canada here.

Related: