Affirm Canada is an instalment payment service or “buy now, pay later” business that allows Canadian consumers to make purchases and pay for them over a specific period.

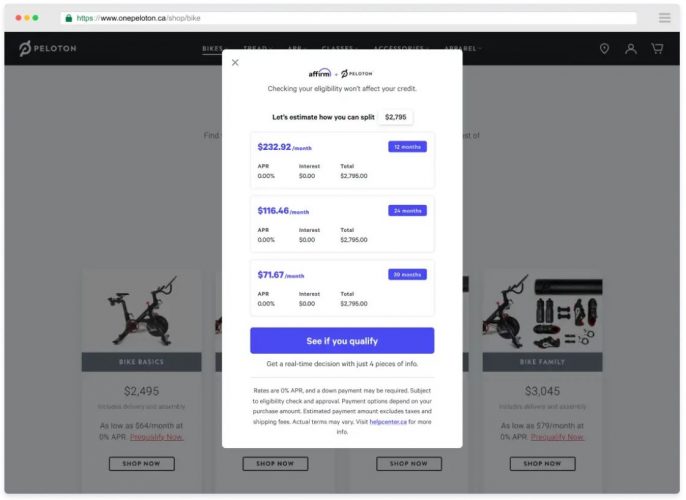

For example, let’s say you want to buy a stationary bike that costs $2,795. Instead of paying this amount at once, you can use Affirm to split the payment over 6, 12, or 24 months.

This makes it easier to buy things you can’t afford to pay for right away while avoiding potentially exorbitant credit card interest payments and fees.

That said, making instalment loan payments has its own downsides, and you can still end up with a damaged credit score and a debt that’s one too many.

What is Affirm Canada?

Affirm is a publicly traded company in the U.S. that provides instalment loans to consumers so they can finance purchases at the point of sale.

It was founded in 2012 and has partnerships with thousands of retailers who sell clothing, electronics, home furniture, fitness equipment, cars, luxury items, and travel.

In 2021, Affirm made a move to establish operations in Canada by acquiring PayBright, a leading “buy now, pay later” company.

PayBright’s instalment payment solutions are available at more than 7,000 merchants in Canada.

When you make a purchase at these stores, you can choose to schedule your payments and may pay interest starting at 0%.

There are no hidden fees, and you know your total cost outlay before completing the transaction.

Affirm PayBright is available in British Columbia, Ontario, Manitoba, Alberta, and Saskatchewan.

How it Works

After adding the items you want to buy at your favourite stores to your cart, choose Affirm at checkout if the merchant supports this method of payment.

Choose the payment schedule that works for you, making a note of the monthly payment amount and applicable interest fees.

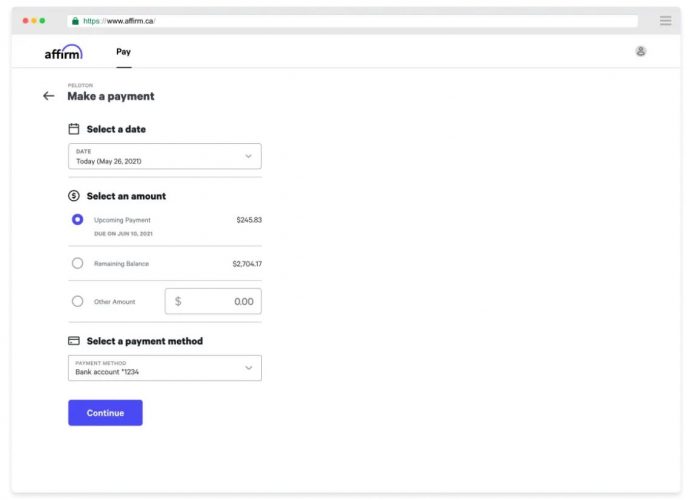

If you qualify for the loan, you can make payments from your Affirm account. They send you email and SMS reminders so you remember your due dates.

Automatic payments can be set up by turning on AutoPay so your bank account is automatically debited without needing to move money manually.

To use Affirm, you must be at least 18 years old, or 19 years if you reside in British Columbia.

Related: Personal Loan Statistics in Canada.

How Much Does Affirm Instalment Loan Cost?

The interest rate on Affirm’s instalment loans ranges from 0-30% APR.

As per their website, you only pay the interest you signed up for when you placed your purchase.

There are no other fees, including late fees, service fees, or prepayment fees.

The company makes money when shoppers (borrowers) pay interest on their loans and also from the commissions they earn from participating merchants.

Benefits of Affirm

- Point of Sale instalment loan that makes it easy to complete purchases online even when you don’t have the cash.

- Upfront costs are apparent and there are no unexpected fees.

- The payment option is available at thousands of retailers in Canada

- It May be cheaper than a credit card

- Prequalification does not affect your credit score.

Downsides of Affirm

- If you cannot make your payments on time, it could negatively impact your credit score.

- While the company mentions that interest rates range between 0% and 30%, borrowers who qualify for the higher range could be paying a lot more than a credit card would cost.

- Easy access to an installment loan could encourage impulsive purchases and cause shoppers to take on too much debt.

Alternatives to Affirm (PayBright)

If you want to finance a short-term purchase, an alternative payment option is to use a low-interest credit card.

The best low interest rate cards in Canada include:

- MBNA True Line Gold Mastercard (8.99%)

- Scotiabank Value Visa Card (12.99%)

- BMO Preferred Rate Mastercard (12.99%)

- HSBC +Rewards Mastercard (11.99%)

Frequently Asked Questions

Does Affirm have a credit card?

In the U.S., Affirm has a waitlist for a new Affirm Card that is expected to work like a debit card.

Does Affirm affect your credit score?

When you apply for an Affirm loan, they check your credit, and this may affect your credit score depending on your payment history over time.

Is Affirm the same as PayBright?

Affirm operates in Canada under the name PayBright, after acquiring the company earlier this year.

What merchants are available through Affirm Canada?

Thousands of retailers support instalment loan payments using Affirm, including Hudson’s Bay, Sephora, Samsung, Bowflex, Browns, Wayfair, eBay, Taylor Made, and Factory Direct.

Is Affirm Canada safe?

Affirm is a legitimate company with millions of users in the United States and Canada. As per its website, it uses encryption to secure your personal data. The company is accredited by the Better Business Bureau and had an A+ rating.

Related: